Jamie Woodwell

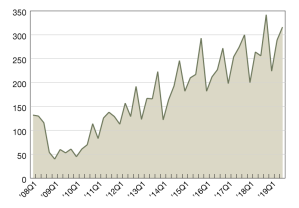

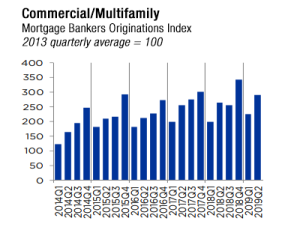

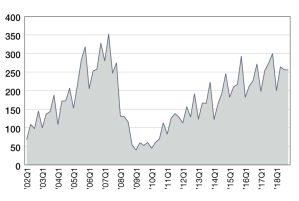

Commercial/Multifamily Mortgage Originations Index

Commercial and multifamily mortgage loan originations increased 24 percent in the third quarter compared to a year ago.

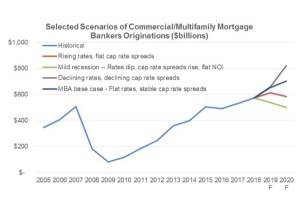

MBA Predicts Record 2020 for Originations

MBA’s more optimistic forecast is driven, in part, by lower interest rates and favorable market conditions, according to Vice President of Research and Economics Jamie Woodwell.

Commercial/Multifamily Mortgage Bankers Originations

MBA now forecasts that commercial and multifamily mortgage bankers will close a record $652 billion of loans backed by income-producing properties this year.

Mortgage Originations Trending Upward

Despite predications for a more tempered lending environment this year, second-quarter originations rose above the same period last year and the momentum is building, according to Jamie Woodwell of the Mortgage Bankers Association.

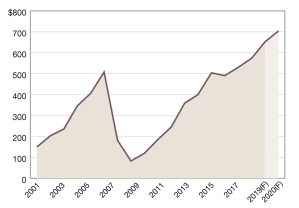

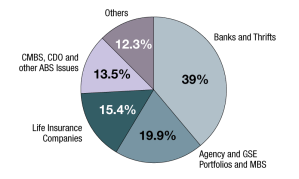

Commercial/Multifamily Mortgage Debt Outstanding

Total commercial/multifamily debt outstanding rose to $3.46 trillion at the end of the first three months of the year.

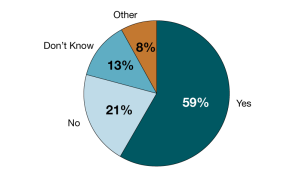

Transitioning From LIBOR

Uncertainty surrounds strategies for managing this watershed change, as many firms wait on the sidelines for others to take the lead, writes MBA’s Jamie Woodwell.

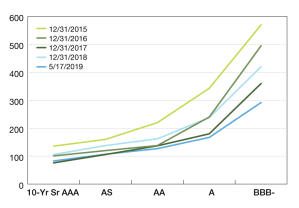

New-Issue CMBS Spreads to Swaps

In addition to the credit curve coming down, it has also flattened, with the spread between single‐A and triple‐A CMBS bonds tightening from 207 bps at the end of 2015 to 84 basis points at the end of 2019.

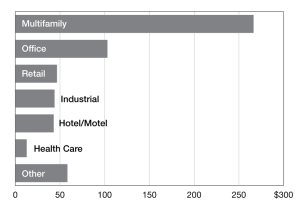

2018 Loan Originations

More loans closed for multifamily properties in 2018 than for any other property type—$266.4 billion, or 46 percent of total volume, according to the Mortgage Bankers Association.

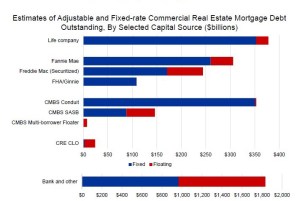

Adjustable vs. Fixed-Rate CRE Debt

With floating-rate loans making up around one-third of the total balance of outstanding commercial real estate mortgages, a LIBOR transition would be a pivotal event for the industry, according to MBA’s Jamie Woodwell.

Commercial/Multifamily Mortgage Originations Index

The market as a whole ended the year roughly flat compared to 2017, continuing a plateau we’ve seen in mortgage borrowing and lending since 2015.