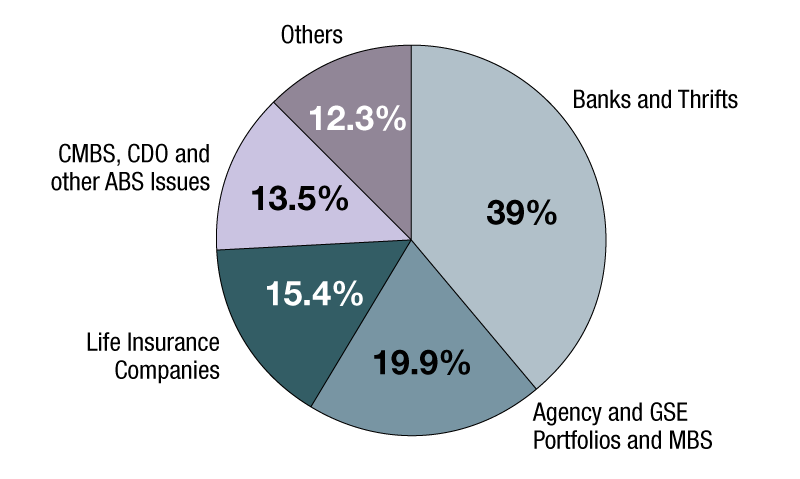

Commercial/Multifamily Mortgage Debt Outstanding

Total commercial/multifamily debt outstanding rose to $3.46 trillion at the end of the first three months of the year.

by investor group, Q1 2019

The level of commercial/multifamily mortgage debt outstanding rose by $45.4 billion (1.3 percent) in the first quarter of 2019, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

Total commercial/multifamily debt outstanding rose to $3.46 trillion at the end of the first three months of the year. Multifamily mortgage debt alone increased $17.9 billion (1.3 percent) to $1.4 trillion from the fourth quarter of 2018.

Mortgage debt backed by commercial and multifamily income-producing properties continues to grow at a strong pace, with three of the four major capital sources—banks, life companies, and the GSEs and FHA—growing their holdings by more than one percent during the first three months of this year.

REITs, finance companies and nonfinancial corporate businesses also showed strong appetites last quarter, with each growing their holdings by more than $1 billion. The depth and breadth of growth among investors signals the continued interest in the sector.

Commercial banks continue to hold the largest share (39 percent) of commercial/multifamily mortgages at $1.4 trillion. Agency and GSE portfolios and MBS are the second largest holders of commercial/multifamily mortgages (20 percent) at $687 billion. Life insurance companies hold $532 billion (15 percent), and CMBS, CDO and other ABS issues hold $466 billion (14 percent).

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.