Finance (Research Center)

Top 5 NYC Retail Building Sales—May 2025

The metro’s top deals for the sector rounded up by PropertyShark.

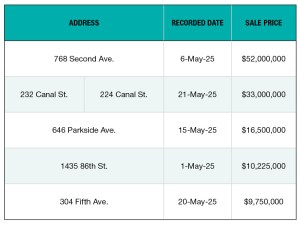

Top 5 NYC Office Building Sales—May 2025

The metro’s top deals for the sector rounded up by PropertyShark.

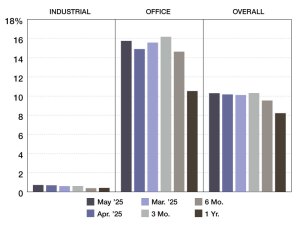

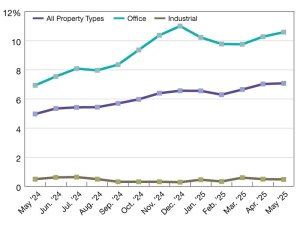

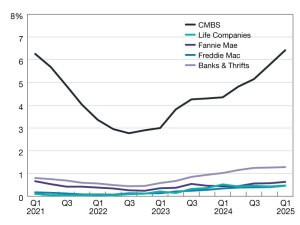

Commercial and Multifamily Mortgage Delinquency Rates Increased in Q1 2025

The uptick in CMBS delinquencies signals stress in some market areas, according to MBA research.

Top 5 NYC Retail Building Sales—April 2025

A list of NYC’s top retail building sales of 2025.

Top 5 NYC Office Building Sales—April 2025

PropertyShark collected the city’s top deals for the sector.

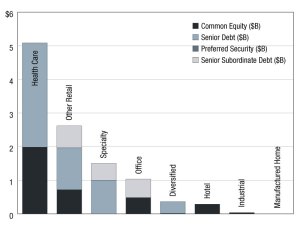

Total Commercial Real Estate Borrowing and Lending Increased in 2024

The total volume grew by 16 percent from the previous year.

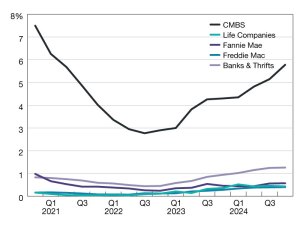

Mortgage Delinquency Rates Increased in Q4 2024

MBA estimates that almost $1 trillion’s worth of loans are maturing in 2025.