Finance

Capital Ideas: Lights Dim on Energy Incentives

The Senate’s version of the big budget bill puts the kibosh on a lot of what the previous administration had promised in terms of clean energy credits and investments.

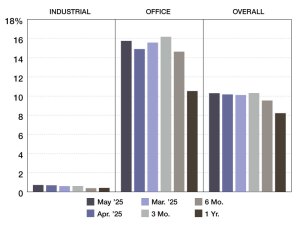

2025 Is Half Over. Are You Thriving Yet?

Gantry’s Robert Slatt on why he’s relatively optimistic about CRE finance for the remainder of the year.

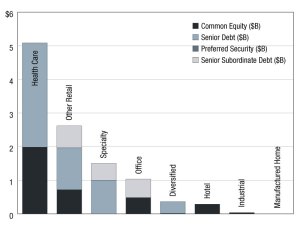

Why CRE’s Transaction Volume Is So Low

This period of the cycle is unlike any seen before, writes Dekel Capital’s Shlomi Ronen.

What the Senate Version of the Big Beautiful Bill Means for CRE

On bonus depreciation, the Senate went even further than the House did.

Brennan JV Secures $253M Portfolio Refi

The collection includes 21 light industrial properties.

Beacon Partners Lands $100M for North Carolina Collection

The industrial properties are spread throughout Charlotte and Raleigh.

Congress to Drop Provision 899 From Budget Bill

The retaliatory tax would have penalized foreign investors for “unfair” taxes in their home countries and put a damper on a critical source of CRE funding.