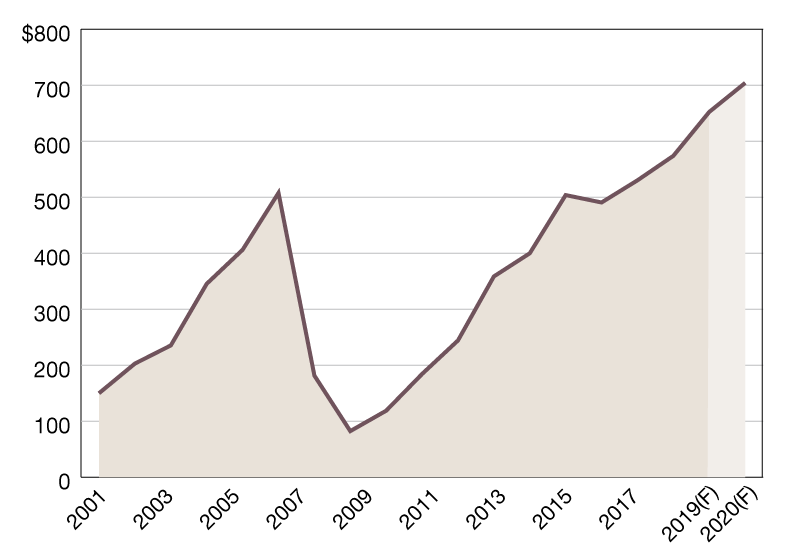

Commercial/Multifamily Mortgage Bankers Originations

MBA now forecasts that commercial and multifamily mortgage bankers will close a record $652 billion of loans backed by income-producing properties this year.

$ in billions

The low interest rate environment, coupled with still strong demand for commercial and multifamily assets, has pushed property values higher and increased demand for mortgages. At the beginning of the year, many economists, investors and others anticipated long-terms rates would currently be in the 3 percent range and rising—potentially putting pressure on property values and decreasing demand for debt. Instead, the 10-year Treasury yield is at approximately 1.7 percent, and many market participants are planning for rates to remain ‘lower for longer.’ The result is heightened demand and higher volumes.

MBA now forecasts that commercial and multifamily mortgage bankers will close a record $652 billion of loans backed by income-producing properties this year, which is 14 percent higher than last year’s record volume ($574 billion).

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.