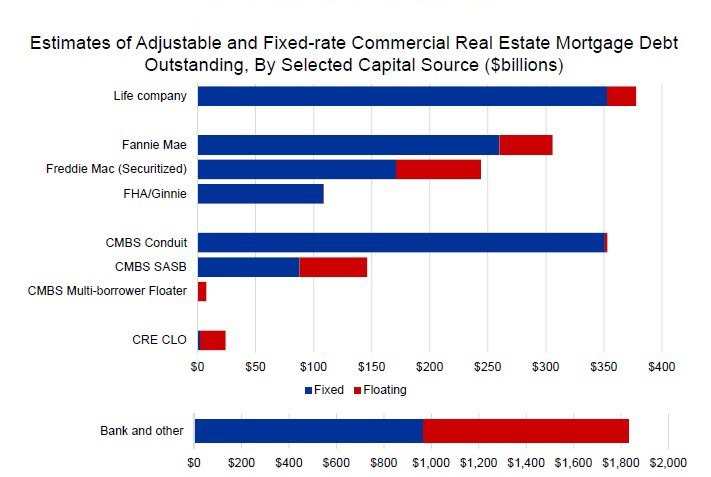

Adjustable vs. Fixed-Rate CRE Debt

With floating-rate loans making up around one-third of the total balance of outstanding commercial real estate mortgages, a LIBOR transition would be a pivotal event for the industry, according to MBA’s Jamie Woodwell.

Source: Mortgage Bankers Association Chart of the Week (April 26, 2019)

The London Interbank Offered Rate is a leading reference rate for adjustable-rate loans in the United States and around the world, and it is targeted to sunset at the end of 2021. Within commercial real estate finance markets, a LIBOR transition would have broad―and varied―impacts, as adjustable-rate mortgages are estimated to make up around one-third of the total balance of mortgage debt outstanding. In this chart, MBA looks at the adjustable and fixed-rate commercial real estate debt outstanding by capital source ($ billions).

Released earlier this year and authored by MBA’s LIBOR Outreach Committee, the “Primer on Evolving Issues for LIBOR Transition and Commercial Mortgage Market Challenges,” is a white paper that offers key action items that member firms need to address, and identifies emerging issues to prepare for in the transition away from LIBOR. The MBA’s LIBOR Outreach Committee recommends that firms:

- Identify and assess existing LIBOR exposure in their portfolio

- Prepare adequate contract fallback language for new floating rate loans being closed today

- Review operational requirements

- Encourage voluntary adoption by lenders and borrowers of the successor rate at such time as all key constituencies have agreed on the means and methods of transitioning to an alternative rate

- Join the Federal Reserve ARRC email distribution for key LIBOR transition updates

- Keep track through ARRC and ISDA regarding hedging products; and

- Manage international implications of a replacement index (for companies with international floating rate portfolios

You must be logged in to post a comment.