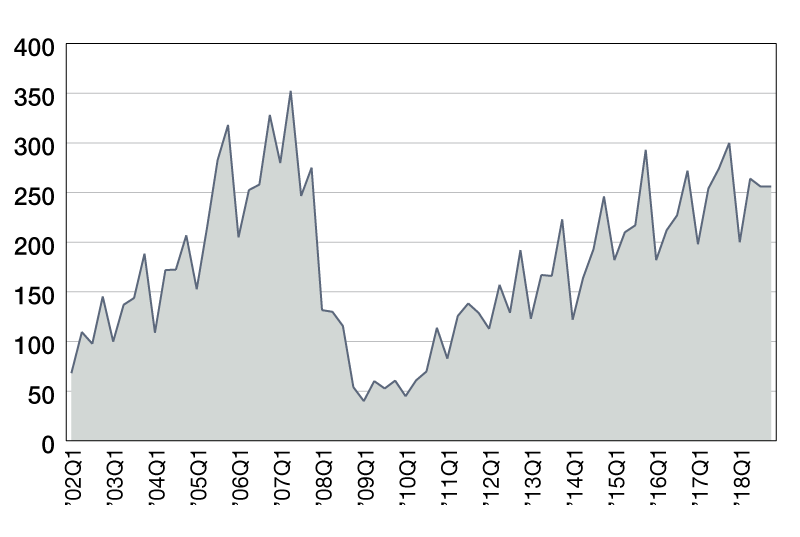

Commercial/Multifamily Mortgage Originations Index

The market as a whole ended the year roughly flat compared to 2017, continuing a plateau we’ve seen in mortgage borrowing and lending since 2015.

2001 quarterly average = 100

A strong final three months of 2018 helped commercial and multifamily mortgage originations increase by three percent overall last year, according to the preliminary estimates from the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Despite the broader market volatility seen as last year came to a close, the year overall ended on a strong note for commercial mortgage borrowing and lending, with fourth quarter originations 14 percent higher than a year earlier.

Investor and lender interest in multifamily and industrial properties continues to drive transaction volumes, while questions about retail and office property markets have slowed activity for those property types. The market as a whole ended the year roughly flat compared to 2017, continuing a plateau we’ve seen in mortgage borrowing and lending since 2015. With 2019 now into the second quarter, we expect to continue to see strong – but mostly unchanged from last year – levels of commercial mortgage borrowing and lending.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

Reggie Booker is the Mortgage Bankers Association’s associate director of commercial real estate research.

You must be logged in to post a comment.