Jamie Woodwell

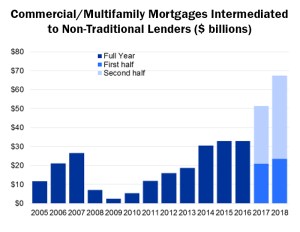

Loans Originated for Non-Traditional Lenders Up 50% Since 2016

Private funds, mortgage REITs and other investor-driven debt providers accounted for nearly 13 percent of intermediated mortgages last year.

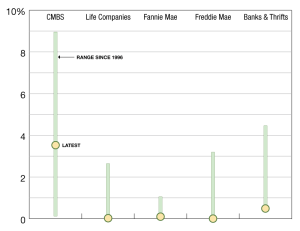

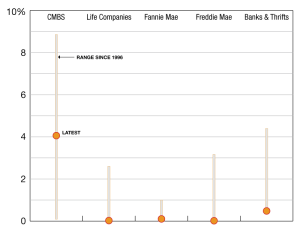

Delinquency Rates and Range

Strong property fundamentals, low interest rates and ample financing options continue to support the ability of multifamily and commercial real estate investors to repay their mortgages.

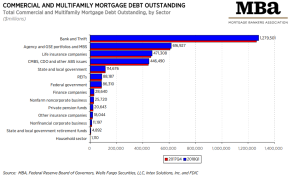

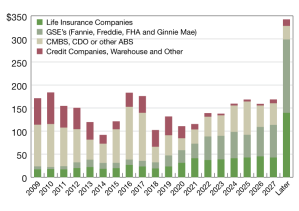

Commercial & Multifamily Debt Outstanding

Record-setting growth across sectors characterized 2018’s first quarter, reported Jamie Woodwell, vice president of commercial real estate research with the Mortgage Bankers Association.

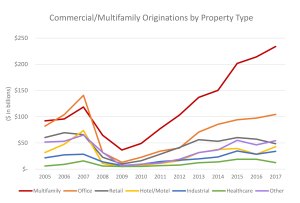

Multifamily Originations Continue to Climb

Multifamily property loans accounted for 44 percent of closed loan activity in 2017, compared to 23 percent a decade earlier, according to Mortgage Bankers Association data.

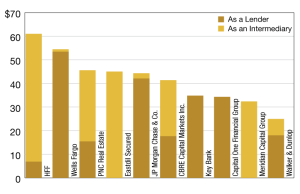

Top 10 Commercial & Multifamily Mortgage Originators

The report tracks 135 firms’ total originations activity, and includes breakouts for loans in which the firm acted as a lender and as an intermediary.

Delinquency Rates and Range

Commercial and multifamily mortgages ended 2017 continuing to perform extraordinarily well.

Non-Bank Commercial/Multifamily Loan Maturities

Because many commercial and multifamily mortgages are 10-year loans, and little debt was issued in 2008 during the onset of the credit crunch, mortgage maturities are 42 percent lower this year than last.

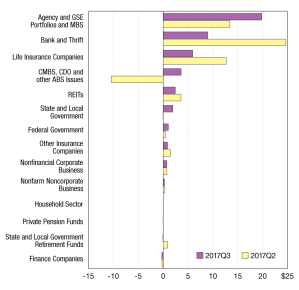

Commercial and Multifamily Mortgage Flows

With only a few exceptions, since 2008, the balance of commercial and multifamily mortgages held in CMBS has declined each quarter.

- « Previous

- 1

- …

- 5

- 6

- 7