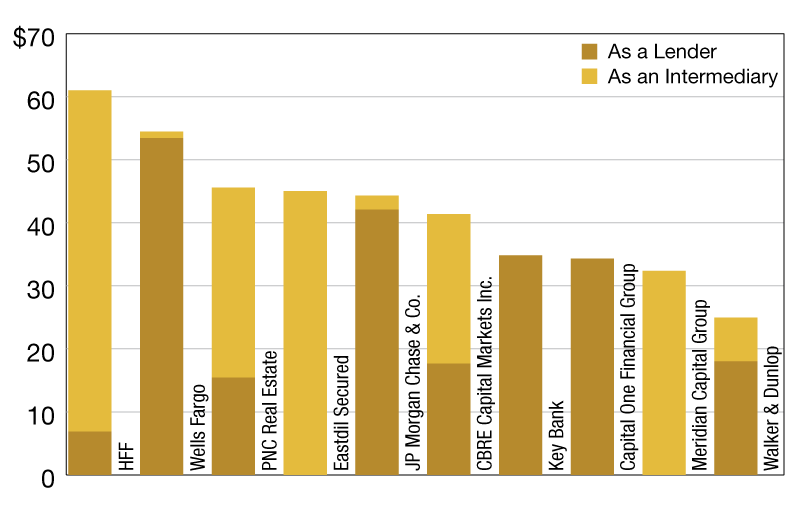

Top 10 Commercial & Multifamily Mortgage Originators

The report tracks 135 firms’ total originations activity, and includes breakouts for loans in which the firm acted as a lender and as an intermediary.

$ in billions

According to a recently released set of commercial/multifamily real estate finance league tables prepared by the Mortgage Bankers Association (MBA), HFF; Wells Fargo; PNC Real Estate; Eastdil Secured; JP Morgan Chase & Co.; CBRE Capital Markets Inc.; Key Bank; Capital One Financial Corp.; Meridian Capital Group; and Walker & Dunlop were the top commercial and multifamily mortgage originators in 2017.

The report tracks 135 firms’ total originations activity, and includes—among others—breakouts for loans in which the firm acted as a lender (closing the loan in their own name) and as an intermediary (in which the loan was closed in someone else’s name). Few firms fall into only one of the two camps, with most originating some loans as a lender and others as an intermediary. Many of the loans closed as a lender may also end up being sold to another entity. The top capital sources in the market include commercial bank and life company portfolios, the government-sponsored enterprises (Fannie Mae and Freddie Mac) and FHA, as well as the commercial mortgage-backed securities (CMBS) market.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

Reggie Booker is the Mortgage Bankers Association’s associate director of commercial real estate research.

You must be logged in to post a comment.