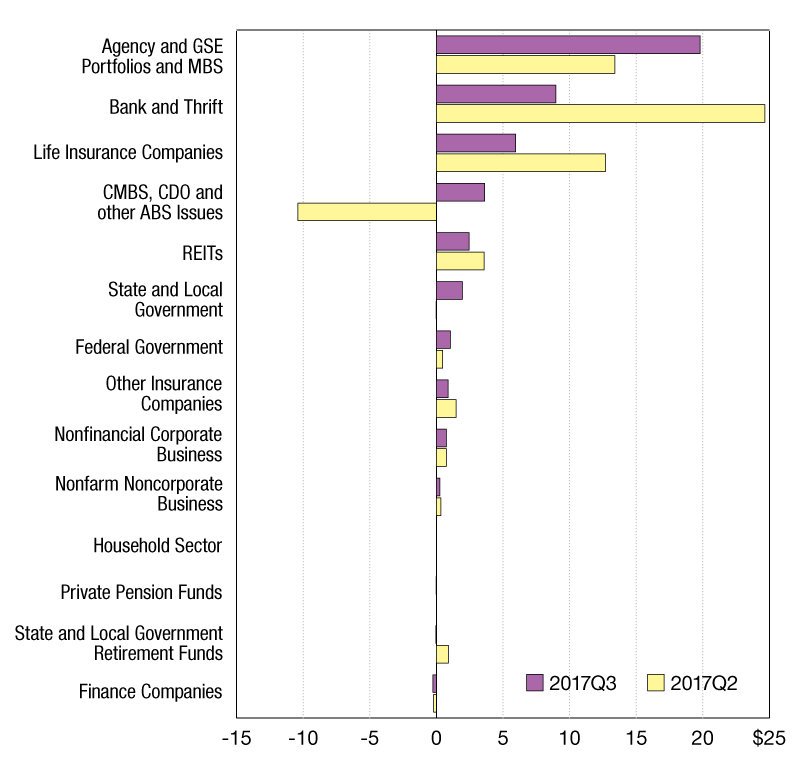

Commercial and Multifamily Mortgage Flows

With only a few exceptions, since 2008, the balance of commercial and multifamily mortgages held in CMBS has declined each quarter.

by Jamie Woodwell

net change in commercial and multifamily mortgage debt outstanding by sector; $ in billions

Sources: MBA, Federal Reserve Board of Governors, Wells Fargo Securities LLC, Intex Solutions Inc. and FDIC

The third quarter marks a significant turning point for the CMBS market. With only a few exceptions, since 2008, the balance of commercial and multifamily mortgages held in CMBS has declined each quarter. That years-long trend ended this quarter. With the so-called ‘wall of maturities’ behind us, and a vibrant market for new originations, we are once again seeing more new loans being originated for CMBS than we are seeing in old loans paying off and paying down. The result is the largest increase in outstanding CMBS mortgages since the end of 2007.

— Jamie Woodwell is MBA’s vice president of Commercial Real Estate Research.

You must be logged in to post a comment.