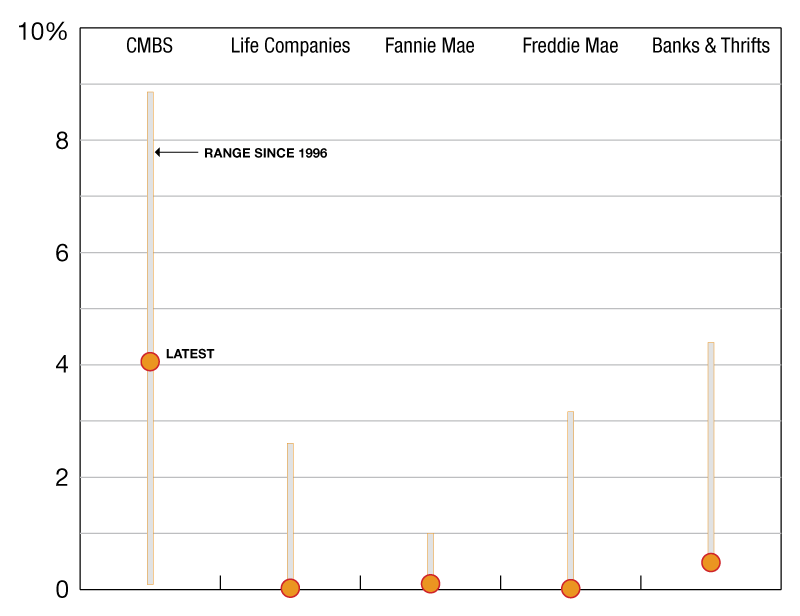

Delinquency Rates and Range

Commercial and multifamily mortgages ended 2017 continuing to perform extraordinarily well.

by Jamie Woodwell

These rates show how performance of loans for each investor groups has varied over time, but cannot be used to compare one investor group to another.

Sources: MBA, Wells Fargo Securities LLC and Intex Solutions Inc., American Council of Life Insurers, Fannie Mae, Freddie Mac, OFHEO and Federal Deposit Insurance Corporation

Commercial and multifamily mortgages ended 2017 continuing to perform extraordinarily well. The market tailwinds of strong fundamentals, increasing property values and ready access to mortgage and other credit all put downward pressure on delinquency rates. Looking at the five largest investor groups, making up 80 percent of commercial/multifamily mortgage debt outstanding, we see that four of the five groups delinquencies are at or essentially at their lowest point since 1996. Only commercial mortgage backed securities (CMBS) have seen significantly lower delinquency rates in any quarter over the last 22 years.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.