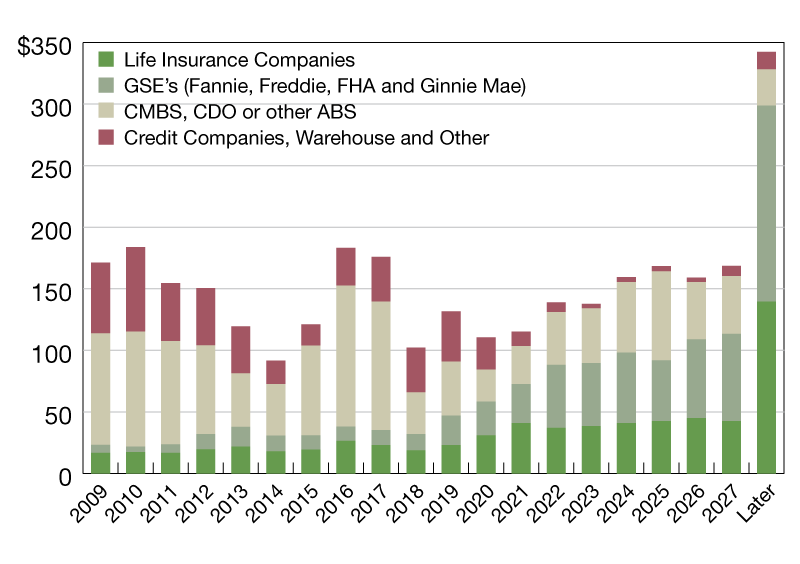

Non-Bank Commercial/Multifamily Loan Maturities

February 21, 2018

Because many commercial and multifamily mortgages are 10-year loans, and little debt was issued in 2008 during the onset of the credit crunch, mortgage maturities are 42 percent lower this year than last.

by Jamie Woodwell

$ in billions

Last year marked the official end of the so-called ‘wall of maturities.’ Because many commercial and multifamily mortgages are 10-year loans, and few loans were made in 2008 during the onset of the credit crunch, mortgage maturities are 42 percent lower this year than last. The strong market has also meant that many loans that were slotted to mature in coming years have already been refinanced, with maturities pushed further out. As a result, commercial and multifamily mortgage maturities slowly climb over the coming years.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.