Jamie Woodwell

Commercial/Multifamily Mortgage Debt Increases

The level of commercial/multifamily mortgage debt outstanding rose by $61.0 billion in the first quarter of 2020, reports MBA’s Jamie Woodwell.

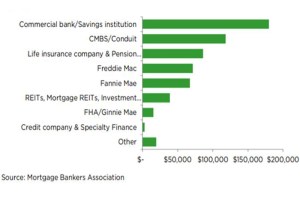

Commercial/Multifamily Borrowing Declines 2 Percent in the 1st Quarter

With stay-at-home measures in place and contractions in the job market and economy, challenging times will continue in the second quarter.

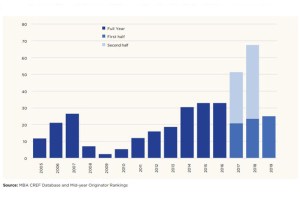

2019 Originations by Lender

This was supposed to be another record-breaking year for mortgage bankers, but originations started declining year-over-year in March, according to MBA’s Jamie Woodwell.

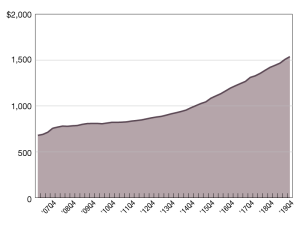

Multifamily Mortgage Debt on the Rise Through Q4 2019; What About 2020?

Continuing the recent trend, the growth in multifamily mortgage debt outpaced that of other property types.

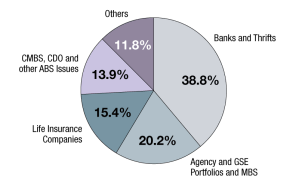

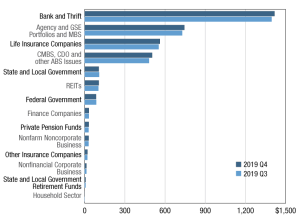

2019 Commercial/Multifamily Mortgage Debt Outstanding

Total commercial/multifamily debt outstanding rose by 7.3 percent at the end of the fourth quarter.

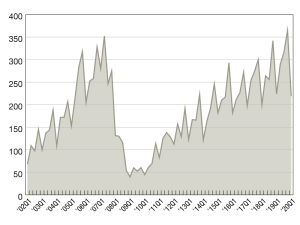

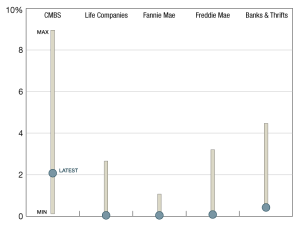

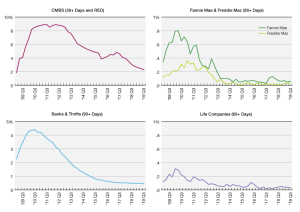

Delinquency Rates and Range

What continues to support the market and is keeping delinquencies low for each of the five largest investor-groups?

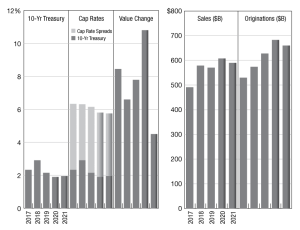

Low Rates Will Boost Borrowing and Lending in 2020

Over the last 20 years, we have seen a strong correlation between property prices and price changes, and property sales and origination activity.

Commercial and Multifamily Loan Maturities to Pick Up in 2020

The Mortgage Bankers Association estimates there will be a 48 percent increase in loan maturities this year.

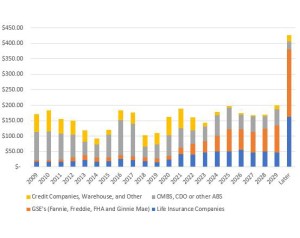

Investor-Driven Lenders Devour More of the Pie

These debt providers have increasingly contributed to the record commercial mortgage finance activity, according to Jamie Woodwell of the Mortgage Bankers Association.

Commercial/Multifamily Mortgage Delinquencies Stay Low

Delinquency rates remain at or near record lows for nearly every capital source.