Commercial/Multifamily Borrowing Declines 2 Percent in the 1st Quarter

With stay-at-home measures in place and contractions in the job market and economy, challenging times will continue in the second quarter.

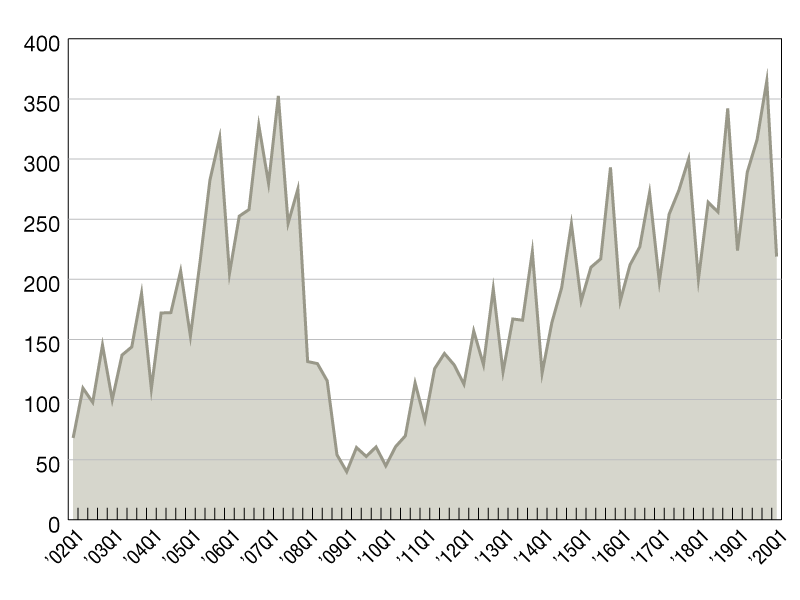

2001 quarterly average = 100

What a difference a month can make. Commercial real estate finance markets were active during most of the first quarter – the start of what was expected to be another strong year of borrowing and lending. That was before the COVID-19 pandemic spread across the U.S., causing essentially a shutdown of the entire economy, along with substantial job losses and financial market volatility.

When all was said and done through the end of the first quarter, commercial and multifamily mortgage loan originations ended up declining 2 percent compared to the same period last year, according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations. In line with seasonality trends, originations the first three months of the year were 40 percent lower than the fourth quarter of 2019.

Early indications are that low interest rates continue to attract some property refinancing, but that overall transaction activity has fallen, given the economic uncertainty stemming from the virus. Property investors and lenders have now turned more of their attention to their existing portfolios instead of new business opportunities.

Compared to the first quarter of 2019, a fall in originations for hotel, industrial and retail properties led this year’s overall first quarter decrease in commercial/multifamily lending volumes. By property type, hotels decreased by 42 percent, industrial decreased by 39 percent, and retail decreased by 37 percent. Office properties increased by 8 percent, multifamily increased by 15 percent, and health care properties increased 16 percent year-over-year.

With stay-at-home measures in place and contractions in the job market and economy, challenging times will continue in the second quarter. One silver-lining for commercial and multifamily lending and borrowing is that interest rates remain exceptionally low.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.