Investor-Driven Lenders Devour More of the Pie

These debt providers have increasingly contributed to the record commercial mortgage finance activity, according to Jamie Woodwell of the Mortgage Bankers Association.

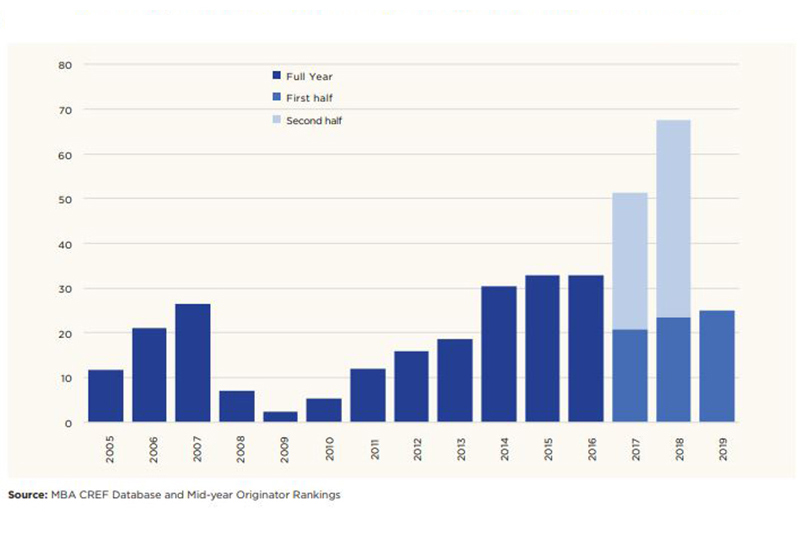

Commercial/Multifamily Mortgages Intermediated to Investor-Driven Lenders (Billions)

In December 2019, MBA released Where from Here?, a new white paper that examines current economic trends and commercial/multifamily real estate market conditions, and summarizes recent comprehensive data—by property type and capital source – reported by MBA’s research team.

The white paper identifies job growth, rising household formation, consumer health, low interest rates, and investors searching for yield as key trends that will likely have a continued impact on demand levels and investor activity in commercial real estate.

In the Capital Sources section of the white paper (starting on p. 12), we highlight what everyone in the industry has experienced in recent years: across all property types, and others, the mortgage markets have been open. In 2018, mortgage bankers originated $574 billion of loans backed by commercial and multifamily properties, a new record and that was 8 percent higher than in 2017. 2019 is on track to surpass last year’s record.

A relatively new group of lenders have increasingly contributed to the record activity and have become a major source of commercial mortgage finance in recent years: investor-driven lenders. These lenders—including debt funds, mortgage REITs, specialty finance companies and others—serve as a channel that allows investors to deploy investment funds in commercial mortgage debt. The sweet spot for many of these groups is providing relatively short-term adjustable rate debt to property owners looking to build or transition a property.

The recent interest in these transitional properties has prompted demand for such debt, and interest from investors looking to put money to work in the commercial mortgage market has boosted the supply of financing. These lenders often use warehouse lines or CRE CLOs to help finance their operations, but hold the core risk (and reward) of the loans for their equity investors. MBA’s Annual Origination Survey tracked $32 billion of mortgage debt intermediated to investor-driven lenders in 2016, $52 billion in 2017 and $67 billion in 2018. In the first half of 2019, 10 percent more volume was intermediated to investor-driven lenders than during the first half of 2018, putting the group on a record pace and closing in on the volume of life insurance companies.

Check out the chart to see the tremendous growth in activity from investor-driven lenders, and be sure to read the white paper.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.