Commercial and Multifamily Loan Maturities to Pick Up in 2020

The Mortgage Bankers Association estimates there will be a 48 percent increase in loan maturities this year.

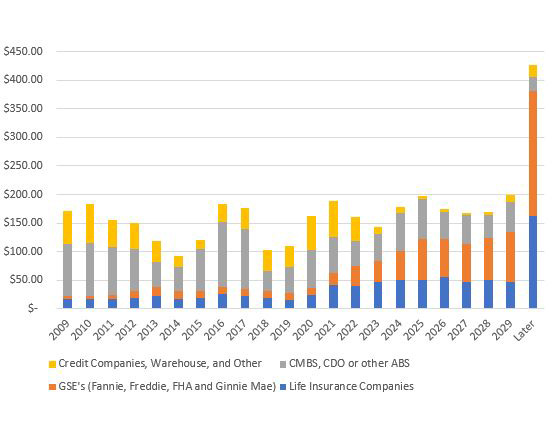

MBA over a decade ago began collecting information on the volume of commercial and multifamily mortgages, held by non-bank lenders, expected to mature in the coming years. Ten years after the lending lull seen during the Great Recession, the data foretold the “wall of maturities” in 2016 and 2017, and also anticipated the fall-off in 2018 and 2019. Now as we enter a new decade— and the financial crisis moves further in the rearview mirror—it is expected that maturities will pick up from the low levels seen the last two years.

According to the Mortgage Bankers Association’sCommercial Real Estate/Multifamily Survey of Loan Maturity Volumes report—released in early February—$163.2 billion of the $2.2 trillion of outstanding commercial and multifamily mortgages held by non-bank lenders and investors will mature in 2020. That is a 48 percent increase from the $110.5 billion that matured in 2019.

However, some context is needed. Given the long-term nature of many commercial mortgages, maturities still remain muted, with just 7 percent of the total balance of non-bank-held mortgages maturing in 2020.

$ IN BILLIONS

Source: Mortage Bankers Association

Loan maturities vary significantly by investor group. Only $11.9 billion (2 percent) of the outstanding balance of multifamily and health care mortgages held or guaranteed by Fannie Mae, Freddie Mac, FHA and Ginnie Mae will mature in 2020. Life insurance companies will see $24.8 billion (4 percent) of their outstanding mortgage balances mature, and among loans held in CMBS, $67.2 billion (11 percent) will come due. Among commercial mortgages held by credit companies and other investors, $59.3 billion (24 percent) will mature this year.

With a typical loan having a term of 10 years, and investors’ maturity schedules are generally designed to match their liabilities. As you can tell from the chart, this year marks the beginning of a ‘return to normalcy’ in the coming years for loan maturities.

Jamie Woodwell is vice president of Commercial and Multifamily Research for the Mortgage Bankers Association.

You must be logged in to post a comment.