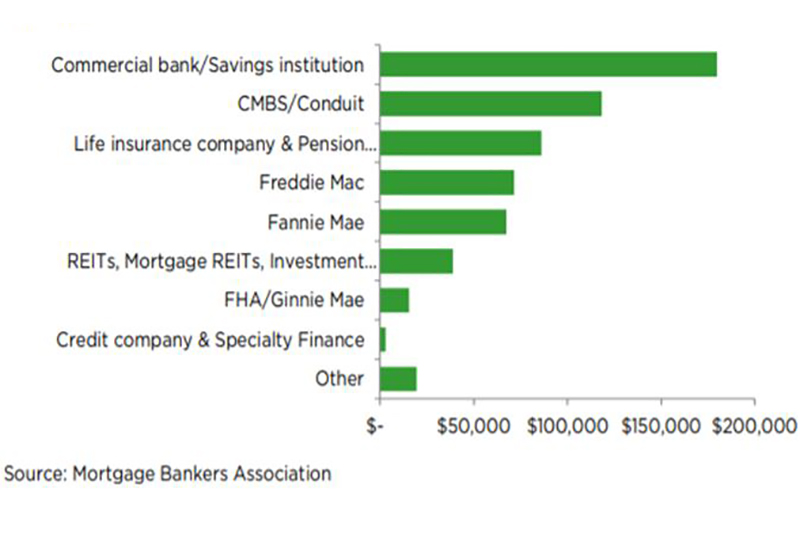

2019 Originations by Lender

This was supposed to be another record-breaking year for mortgage bankers, but originations started declining year-over-year in March, according to MBA's Jamie Woodwell.

Originations By Lender (in Millions)

Commercial and multifamily mortgage bankers closed a record $600.6 billion of loans in 2019, according to the Mortgage Bankers Association’s 2019 Commercial Real Estate/Multifamily Finance Annual Origination Volume Summation.

Commercial and multifamily mortgage bankers closed a record $600.6 billion of loans in 2019, according to the Mortgage Bankers Association’s 2019 Commercial Real Estate/Multifamily Finance Annual Origination Volume Summation.

This year was poised to be close to another banner year. That was before the COVID-19 pandemic spread across the U.S. and wreaked havoc on the entire economy. Substantial job losses, financial market volatility and overall uncertainty have impacted commercial real estate finance markets since March. In the first quarter, commercial and multifamily mortgage loan originations ended up declining 2 percent compared to the same period last year. It’s very likely activity will pull back even more in the second quarter.

Jamie Woodwell, MBA

Looking back at last year, commercial bank portfolios were the leading capital source for originated loans in 2019, responsible for $179.8 billion of the total (30 percent). The second-most active investor group was GSEs with a total of $139.1 billion (23 percent of the total), followed by CMBS, CDO and ABS issuers with a combined $118.4 billion in activity (20 percent of the total), and life insurance companies and pension funds with $86.1 billion (14 percent of the total). Lenders reported closing $39.0 billion (7 percent) of loans for REITs, mortgage REITs and investment funds, $15.6 billion (3 percent) for FHA/Ginnie Mae, and $3.1 billion (1 percent) of loans for credit companies and specialty finance companies. A total of $19.5 billion (3 percent of total) of commercial/multifamily loans closed as a lender is classified as for ‘other investor types’ by participants.

In terms of property types, multifamily properties had the highest volume of mortgage bankers’ origination volume at $287.2 billion, followed by office buildings, industrial properties, retail, hotels/motels and health care. First liens accounted for 94 percent of the total dollar volume closed last year.

MBA is closely monitoring the impact of the COVID-19 pandemic on its members and the industry.

Jamie Woodwell is chief economist for the Mortgage Bankers Association.

You must be logged in to post a comment.