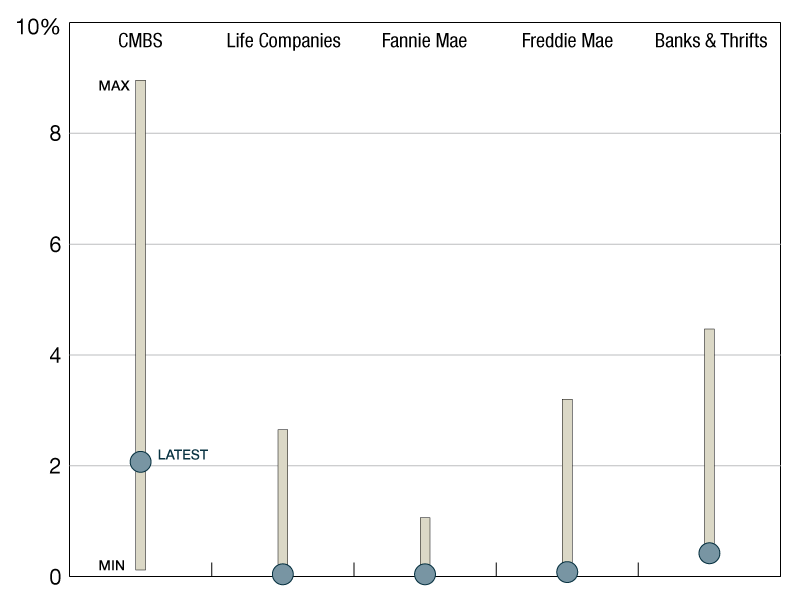

Delinquency Rates and Range

What continues to support the market and is keeping delinquencies low for each of the five largest investor-groups?

Commercial/Multifamily Mortgage Delinquency Report for Q4 2019

MBA recently released its Commercial/Multifamily Mortgage Delinquency report for the final three months of 2019. Commercial and multifamily mortgages ended 2019 much the way they started the year–at or near record-low delinquency rates.

What continues to support the market and is keeping delinquencies low for each of the five largest investor-groups? You can chalk it up to solid property fundamentals, strong property values, and low interest rates.

Looking ahead, it is too early to tell if–and how–concerns tied to the coronavirus and the related global slowdown will affect commercial real estate loan performance. In the short-term, the corresponding drop in financing costs will provide additional support.

To see just how low delinquencies are (through 2019), check out the chart on the rates and ranges for CMBS, life companies, Fannie Mae, Freddie Mac and banks and thrifts.

Jamie Woodwell, MBA VP of Commercial Research

You must be logged in to post a comment.