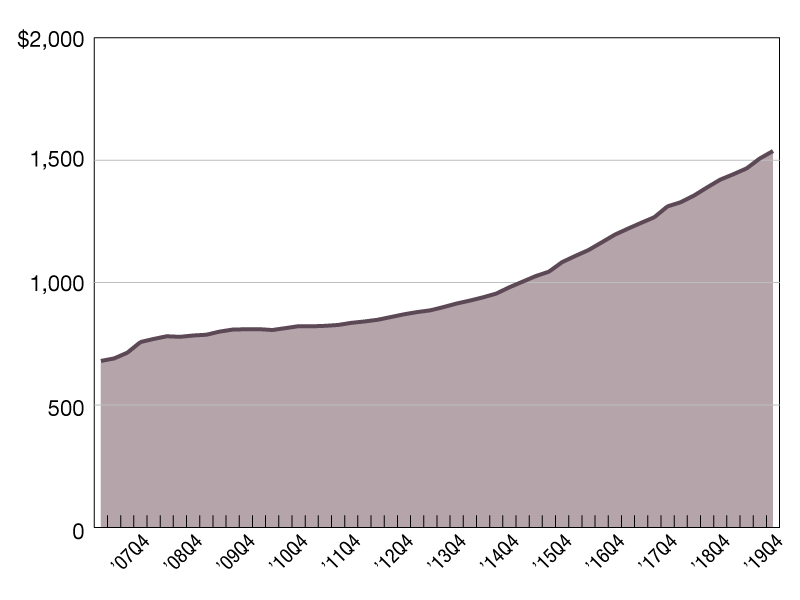

Multifamily Mortgage Debt on the Rise Through Q4 2019; What About 2020?

Continuing the recent trend, the growth in multifamily mortgage debt outpaced that of other property types.

$ in billions

The amount of mortgage debt backed by commercial and multifamily properties grew by the largest annual amount since before the Global Financial Crisis, according to MBA’s recently released Commercial/Multifamily Mortgage Debt Outstanding quarterly report for the final three months of 2019.

Continuing the recent trend, the growth in multifamily mortgage debt outpaced that of other property types. Multifamily mortgage debt grew by $30.4 billion (2.0 percent) to $1.53 trillion during the fourth quarter, and by $116.7 billion (8.2 percent) for the entire year.

Given today’s uncertainty, it’s too early to tell what 2020 will look like for the sector. The multifamily market remains among the most remote to the immediate impacts of the virus. The number of households tends to be more resilient during a recession than the number of jobs. The nature of the current situation, however, is different than many other downturns. With restaurants and other establishments closing (most temporarily), the expectation that many households may see reduced paychecks raises the question of how apartment owners can and will respond.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

—Posted on Apr. 24, 2020

You must be logged in to post a comment.