Transitioning From LIBOR

Uncertainty surrounds strategies for managing this watershed change, as many firms wait on the sidelines for others to take the lead, writes MBA’s Jamie Woodwell.

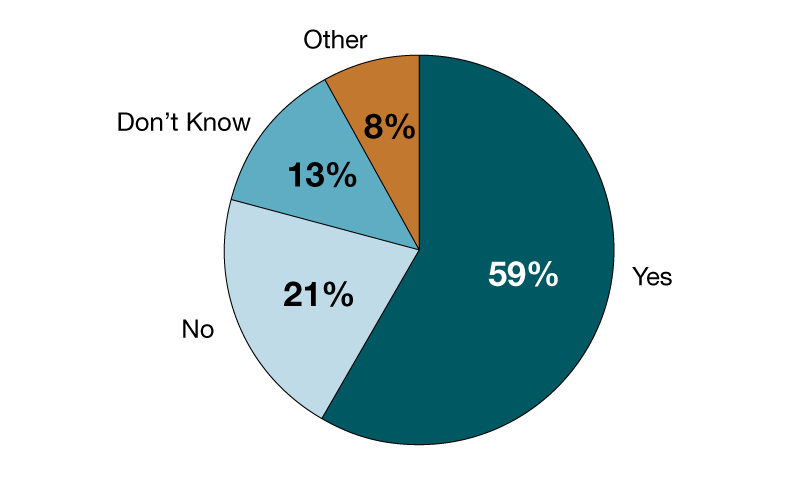

Are you relying on regulators/industry-bodies to make decisions before you take certain actions?

The vast majority of commercial and multifamily mortgage lenders report they are working on the transition away from LIBOR, but the devil is in the details. Most firms are already taking steps, but they also report relying on regulators and industry‐bodies to make decisions before they take certain actions. The net result is a fair amount of uncertainty about the mechanics of the transition away from LIBOR, and an overall hesitation as many firms wait for others to lead the way.

Released in June, MBA’s survey of commercial/multifamily mortgage lenders found that 92 percent of respondents have begun planning for the transition away from LIBOR, and 77 percent have already adjusted LIBOR fallback language in all new loan documents. More than half—56 percent—say they are right on track in preparing for a future without LIBOR.

When it comes to detailed plans for the transition, surveyed firms’ responses are more varied. For example, just less than half (41 percent) said they anticipate using the Secured Overnight Financing Rate (SOFR) as the alternative to LIBOR. When asked if they will follow the recommendations of the Alternative Reference Rates Committee (ARRC), 59 percent said they don’t know. More than half of firms (59 percent) said they are relying on regulators/industry‐bodies to make decisions before they take certain actions.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.