Global

European Property Returns Recovered on Industrial Strength and Positive Currency Impact from U.K. Assets

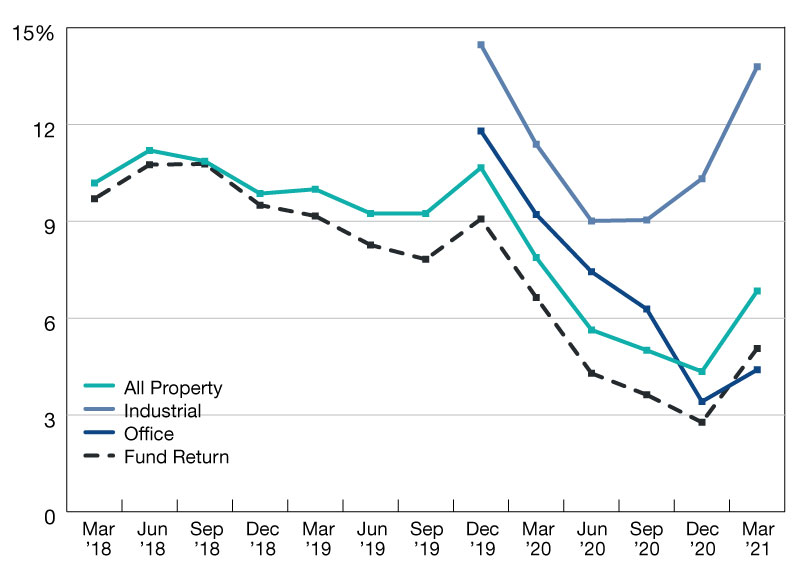

The MSCI Pan-European Quarterly Property Fund Index (PEPFI) recorded an annual fund return of 5.1 percent as of March 2021.

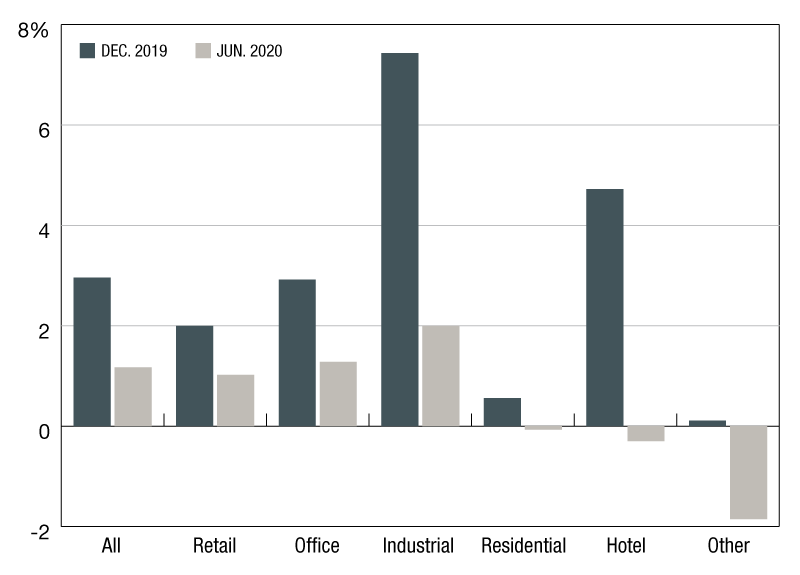

Returns for the MSCI Italy Annual Property Index slowed across all sectors in 2020

On an All Property level, a total return of 2.7 percent was recorded for the year which was down from 5.5 percent in 2019.

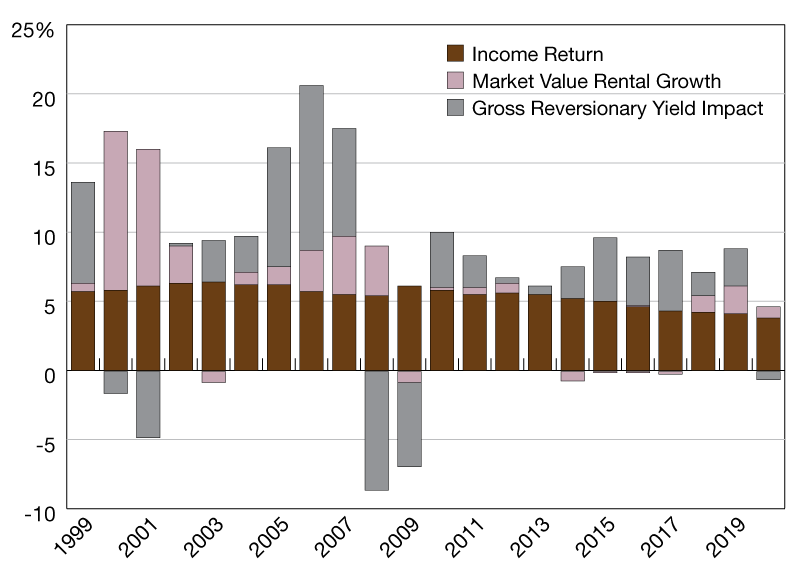

French Property Returns Lowest Since GFC in 2020

French property recorded a total return of 3.2 percent p.a. at December 2020, according to the MSCI France Annual Property Index.

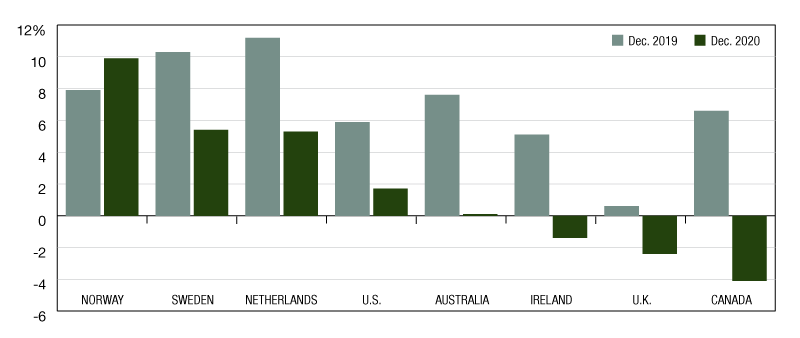

Norwegian Property up 200bps as Returns Dipped Elsewhere

Norwegian real estate returns improved 200bps to 9.9 percent in 2020, in contrast to most global markets.

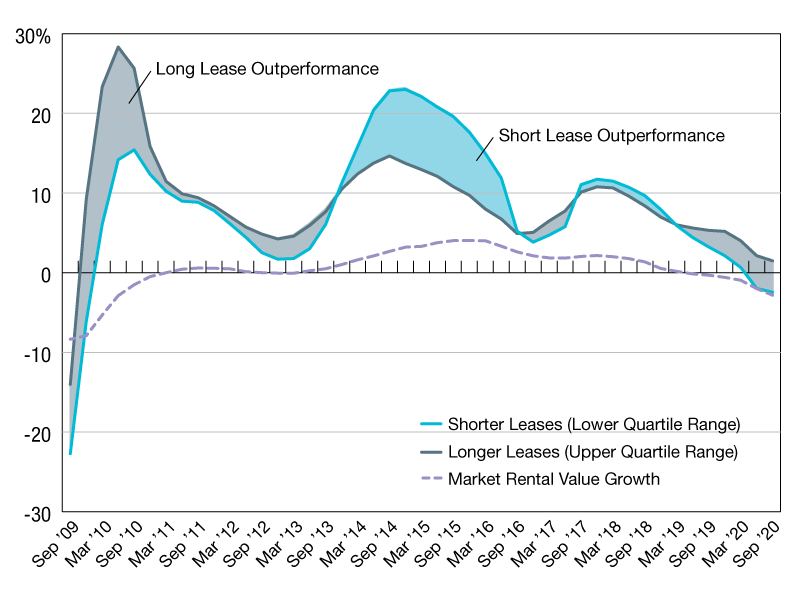

Longer Leases a Boost for Weakening Markets, A Drag for Rising Ones

For the year ended September 2020, longer- and shorter-leased UK assets returned +1.5 percent and -2.5 percent, respectively.

Offices Underpinned Italian Property Return but Segment Performance Widely Dispersed

Italian property returns slowed to 1.2 percent for the first six months of 2020 —from 3.0 percent in the second half of 2019.

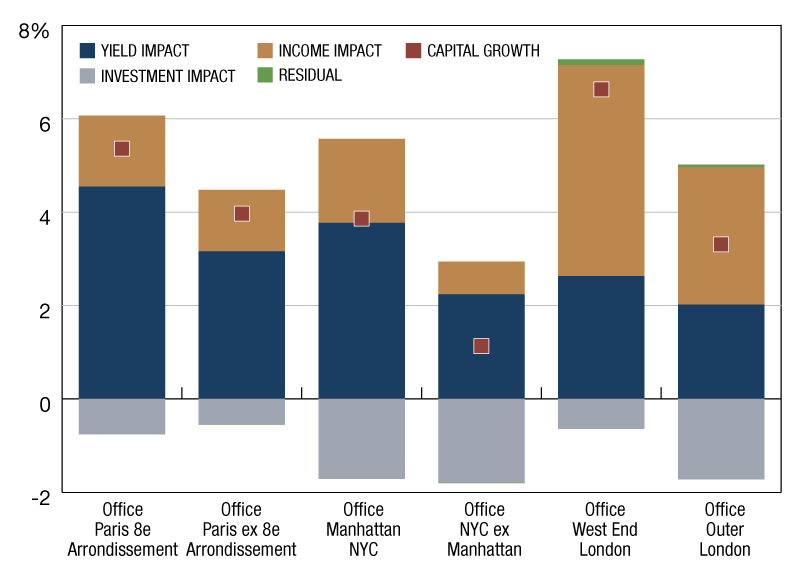

Location Within Gateway Cities Mattered

Over the 10-year period to June 2020, these prime locations within the global cities all produced superior capital growth when compared to the rest of the city.

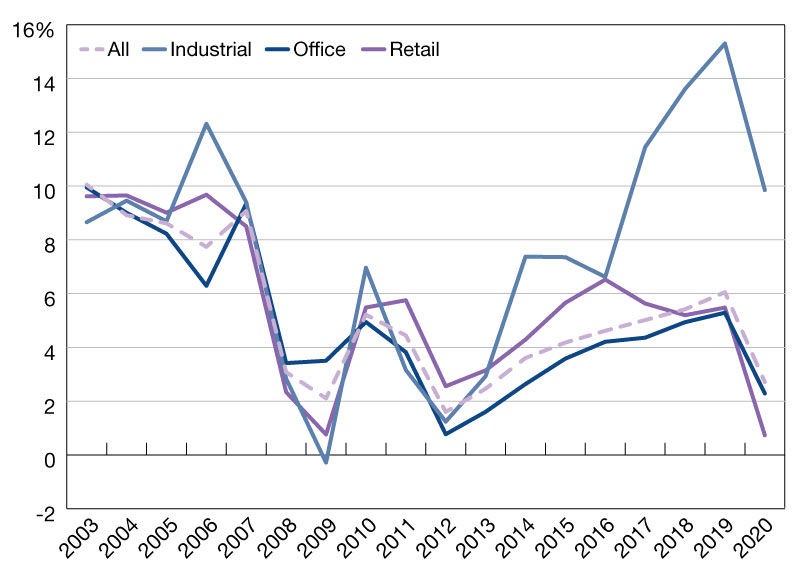

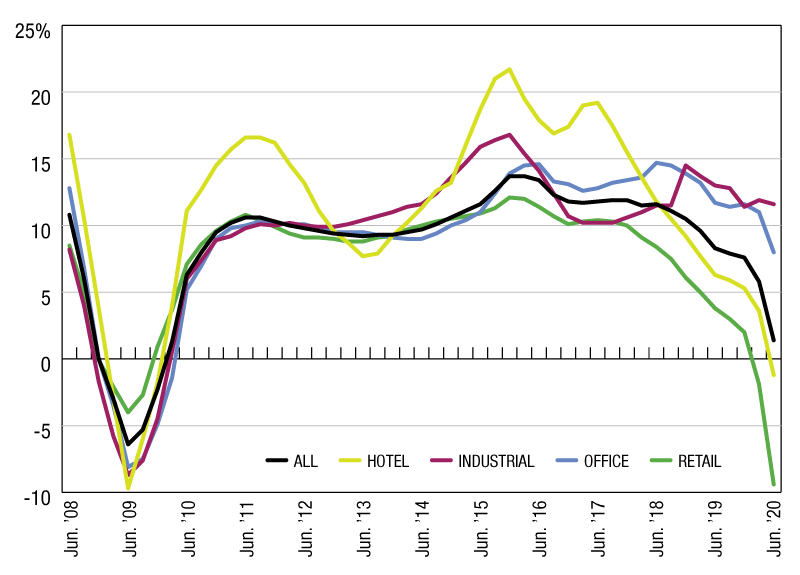

Australia Property Returns Lower as Retail and Industrial Returns Further Dislocate

Australian property returns slowed to -2.5 percent in the second quarter of 2020—the lowest quarterly return since 2009.

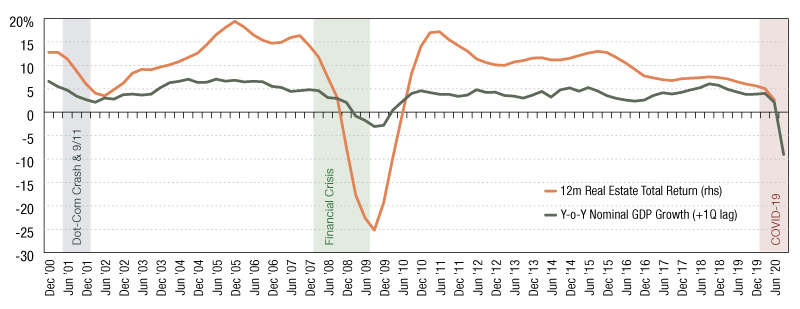

U.S. GDP Growth and Property Returns

Over the first six months of 2020, total returns according to the MSCI/PREA U.S. ACOE Quarterly Property Fund Index have already softened.