European Property Returns Recovered on Industrial Strength and Positive Currency Impact from U.K. Assets

The MSCI Pan-European Quarterly Property Fund Index (PEPFI) recorded an annual fund return of 5.1 percent as of March 2021.

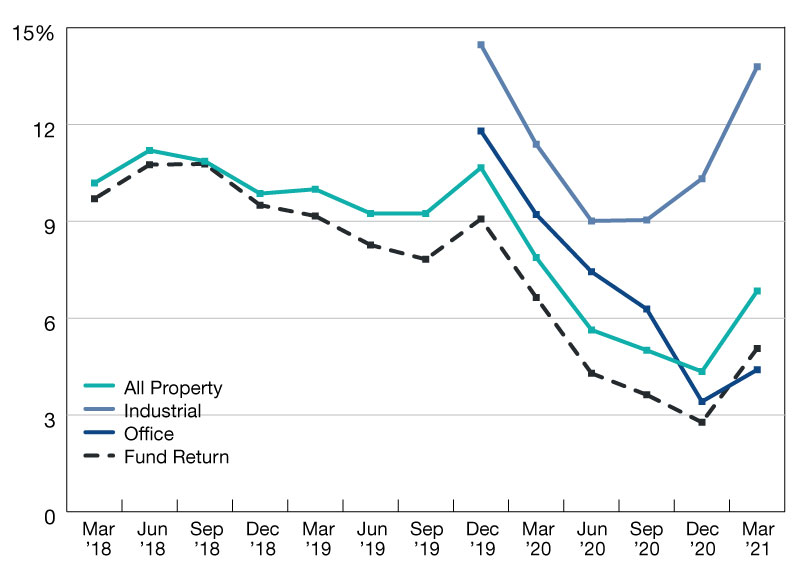

Annual Total Return; Standing Investments

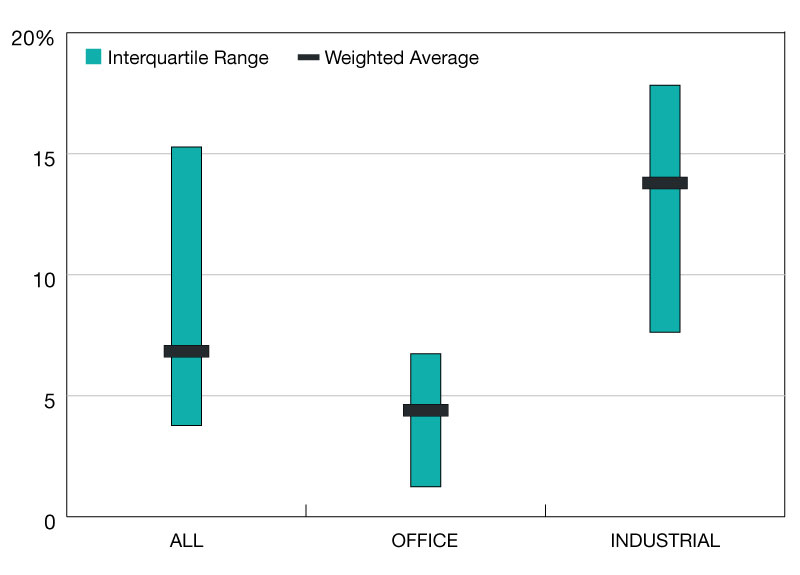

Range of Annual Returns; Standing Investments

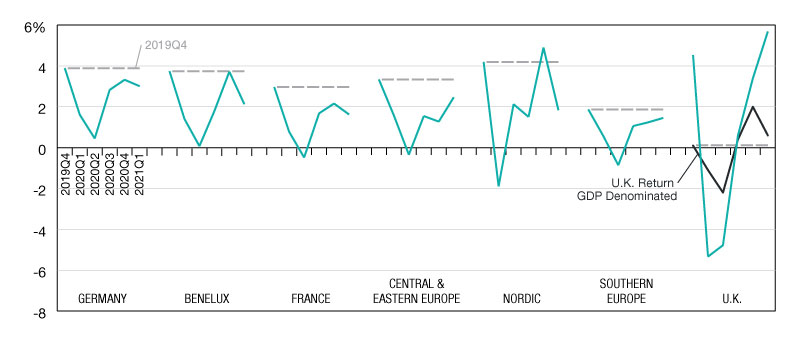

Quarterly Total Return; Standing Investments

European property funds saw both their fund and asset-level returns improve in the year to March 2021.

The MSCI Pan-European Quarterly Property Fund Index (PEPFI) recorded an annual fund return of 5.1 percent as of March 2021 while the index’s asset-level return was higher, at 6.8 percent, as industrial property’s strong performance (13.8 percent) continued.

Within the industrial sector, warehousing and logistics properties continued to perform well as growth in ecommerce buoyed demand in these segments. The office sector followed with an annual return of 4.4% percent—the sector also had the tightest distribution of returns around its weighted average.

All regions delivered positive quarterly returns in Q1 2021, but apart from the United Kingdom remained below their pre-pandemic levels. The U.K. outperformed other regions with a Euro-denominated quarterly return of 5.7 percent on the back of a strong pound, compared to 0.6 percent for U.K.-based investors.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.