Global

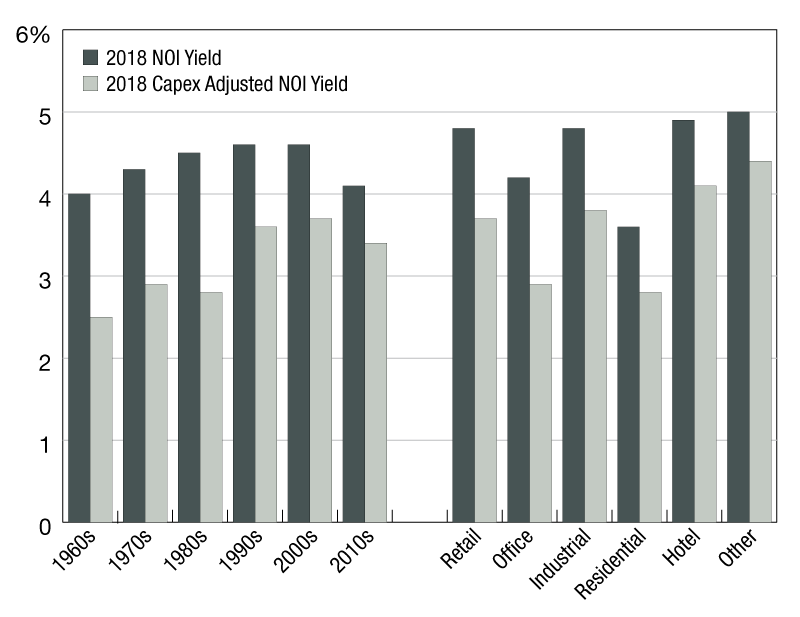

NOI vs. Capex Yield

Variables such as age, location and property type can influence how much capex is required to operate an asset.

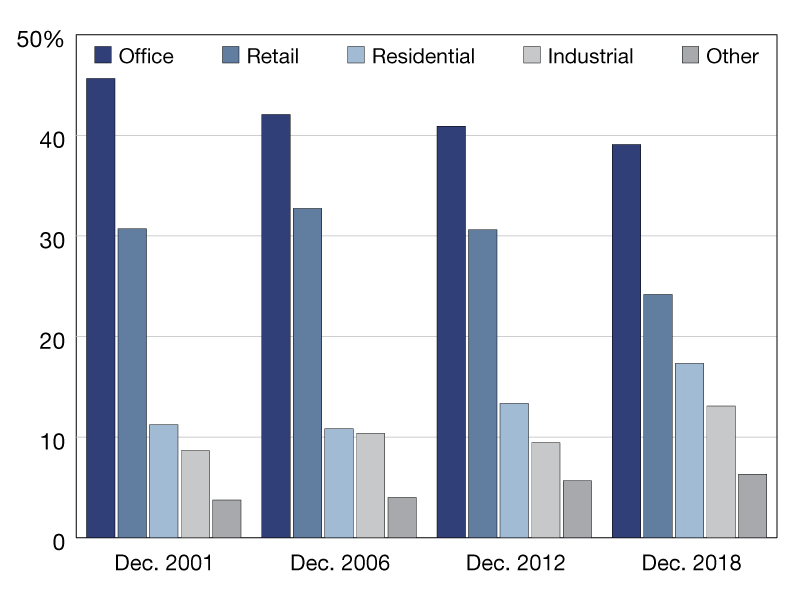

Global Annual Property Index

In 2001, office and retail accounted for 46 and 31 percent, respectively, of capital value in the MSCI Global Annual Property Index. However, now they account for less than two-thirds.

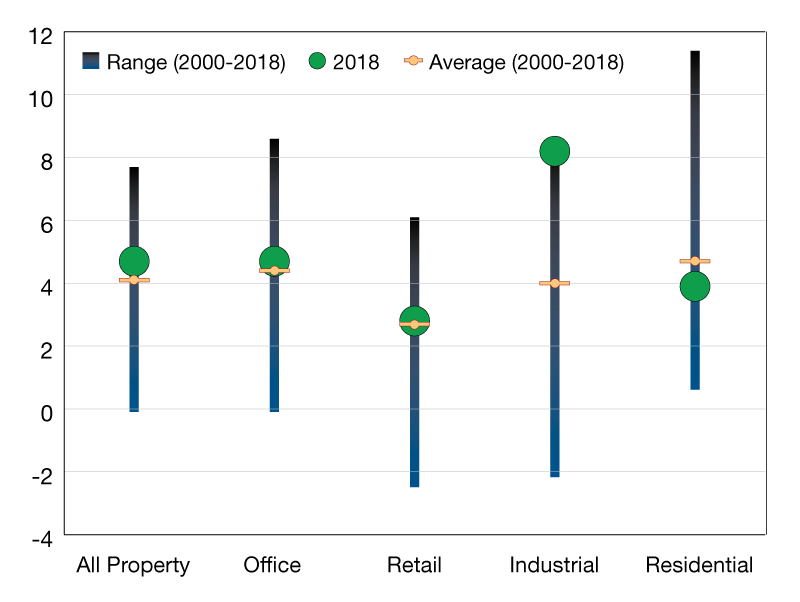

Sales Price

While retail had the lowest premium across the sectors in 2018, it was in line with its 20-year average, as were the office and residential sectors.

Global Annual Property Index

As interest rates have fallen, the discount rates on real estate cash flows have followed, helping to drive up asset values.

U.S. Quarterly Property Index

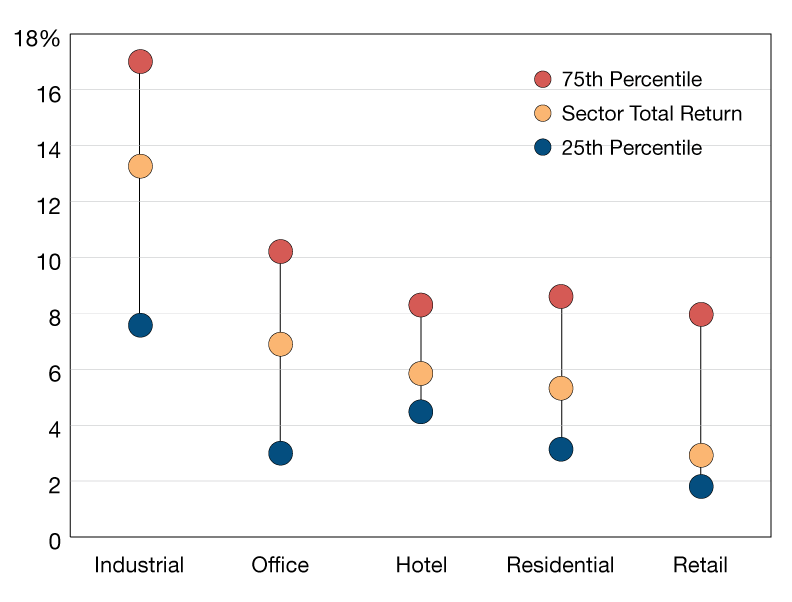

The highest total return was achieved by the industrial sector at 13.3 percent and the weakest total return was for retail at 2.9 percent.

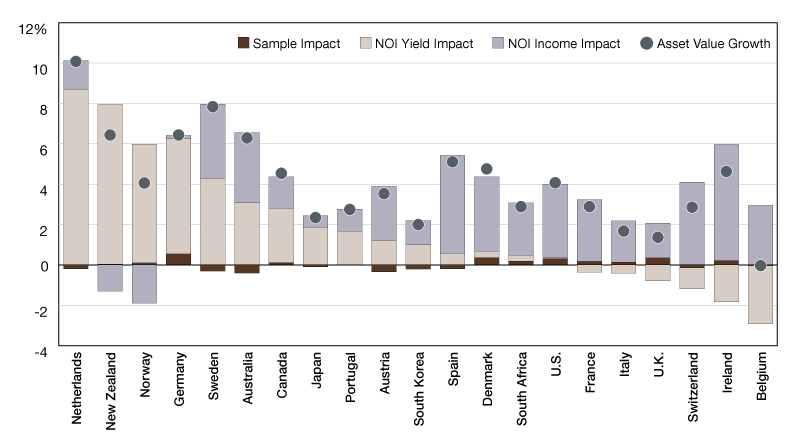

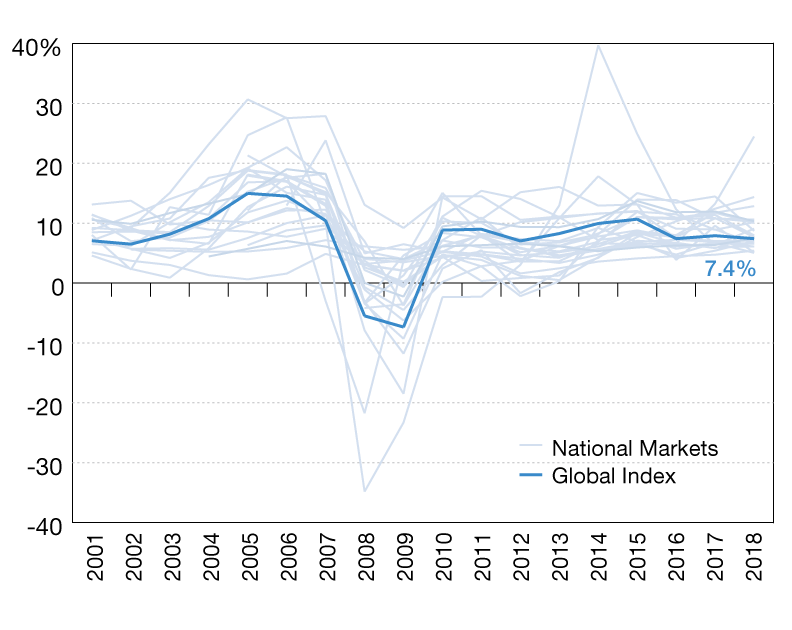

Global Private Real Estate Total Returns

The MSCI Global Annual Property Index found that commercial real estate achieved a total return of 7.4 percent in 2018.

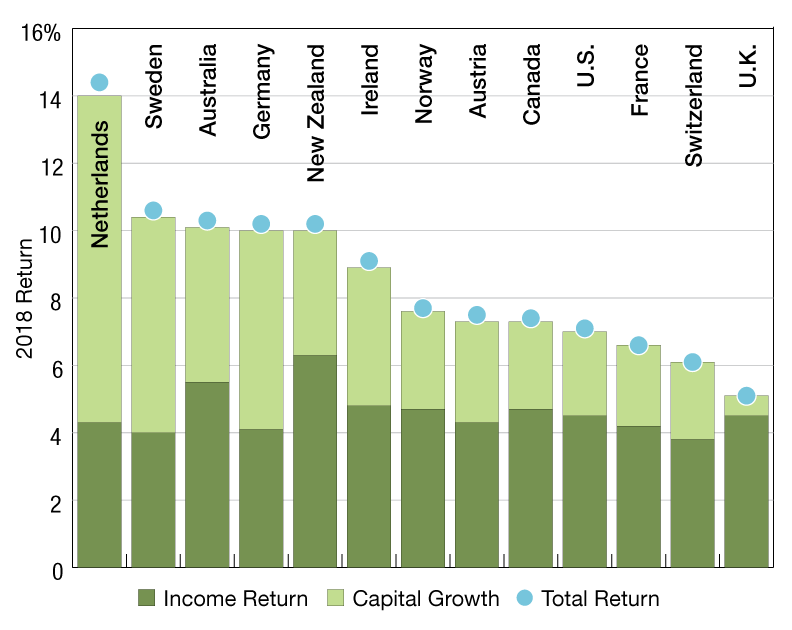

Global Annual Property Index

Capital growth was positive in all the markets though in the U.K. it was just 0.6 percent.

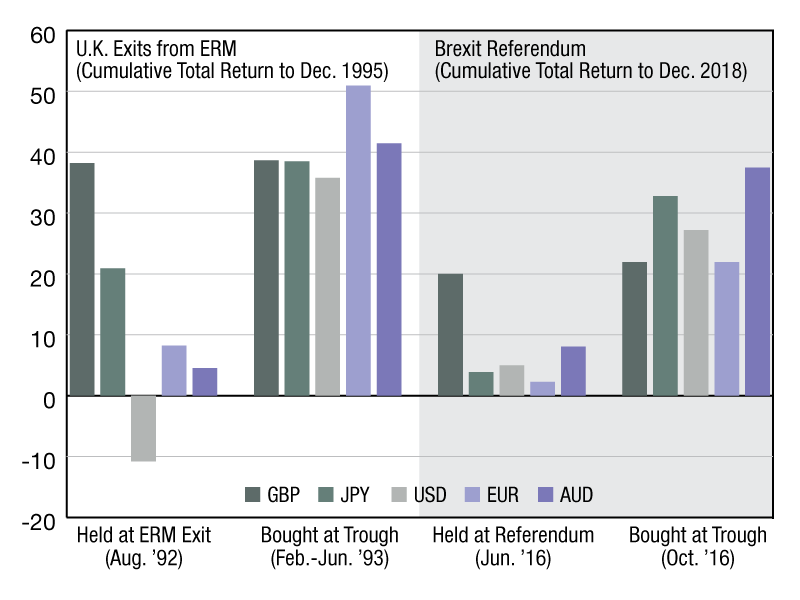

UK Crises Created Opportunities in Non-GBP-Denominated Currencies

Foreign currency denominated returns in the MSCI UK Monthly Property Index made during the post-event troughs significantly outperformed a GBP-denominated investment over similar periods.

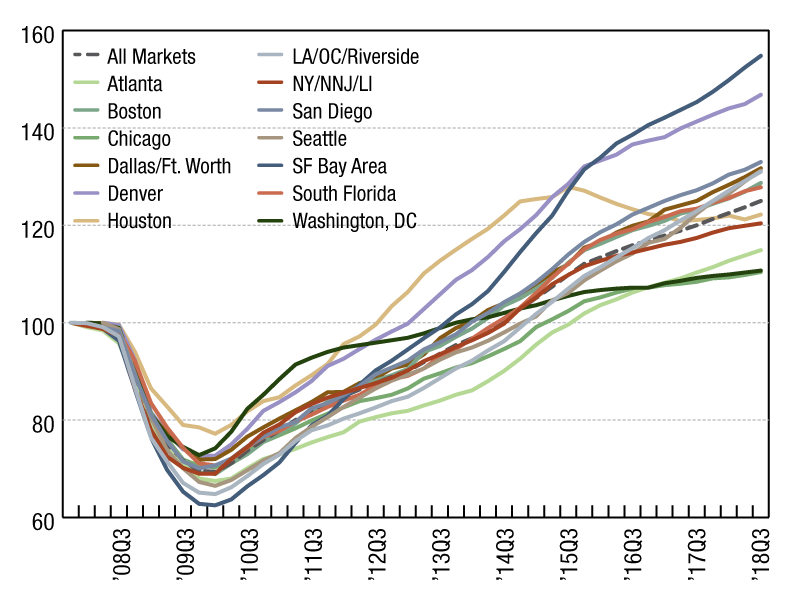

Asset Value Growth Indexes

As of the end of the third quarter 2018, asset values were 25 percent higher than their pre-recession peak, according to the MSCI U.S. Quarterly Property Index.