Sales Price

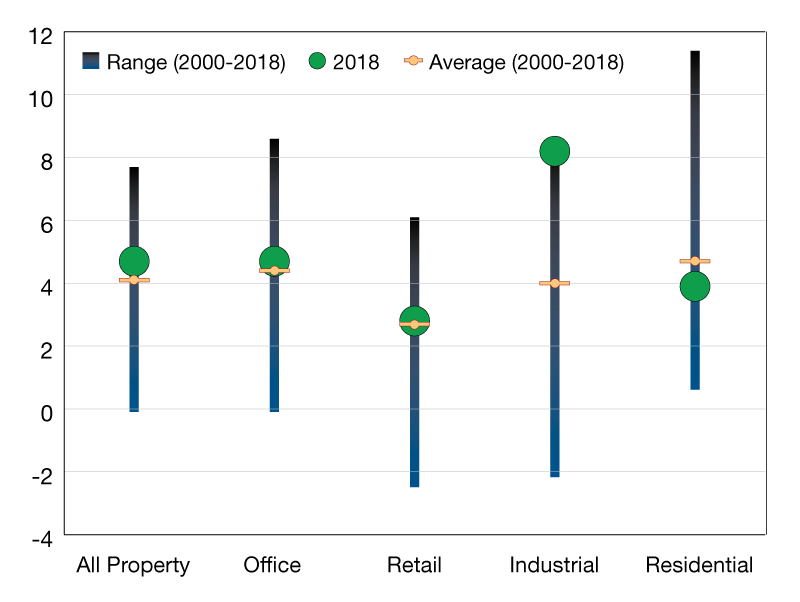

While retail had the lowest premium across the sectors in 2018, it was in line with its 20-year average, as were the office and residential sectors.

Premium/Discount to Most Recent Valuation

Appraisers of retail real estate have come in for criticism for excessive bullishness. Media commentary has fixated on the shuttering of shops, while retail-focused REITs are priced at substantial discounts to the value of their assets. Against this backdrop, many question whether appraisers are overvaluing retail properties. But MSCI data on transacted assets suggests that appraisers haven’t been over-optimistic on the retail sector; and, if anything, they appear to have appraised retail assets more accurately than other property sectors—industrial real estate, in particular.

Countering some commentators’ skepticism, assets transacted during 2018 in the MSCI Global annual Propery Index (across all sectors, including retail) were sold at premia, rather than discounts, to their most recent valuations, as the exhibit indicates. While retail had the lowest premium across the sectors in 2018, it was in line with its 20-year average, as were the office and residential sectors. Meanwhile, industrial’s weighted average premium was at a record high.

Insights and data provided by MSCI Real Estate, a leading provider of real estate investment tools. A Vice President in MSCI’s global real estate research team, Reid focuses on performance measurement, portfolio management and risk related research for asset owners and investment managers. Based in Sydney, he covers APAC as well as global markets.

You must be logged in to post a comment.