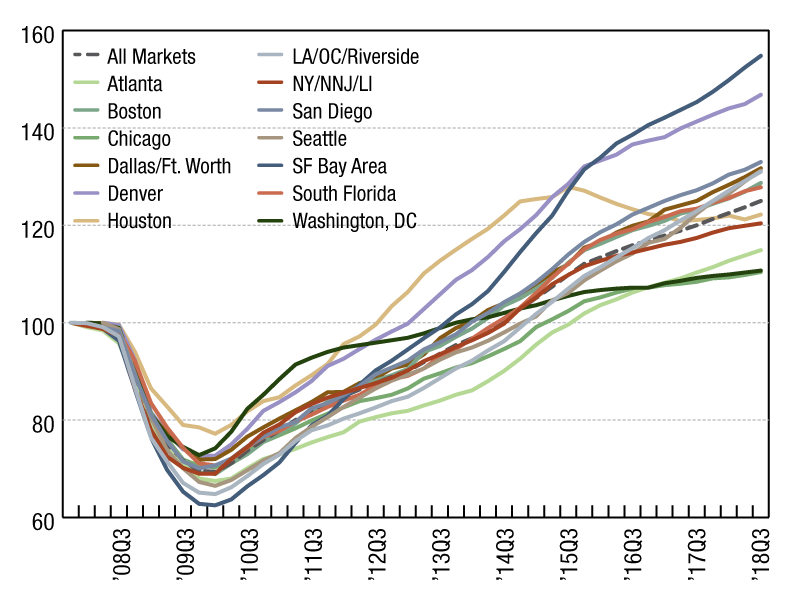

Asset Value Growth Indexes

As of the end of the third quarter 2018, asset values were 25 percent higher than their pre-recession peak, according to the MSCI U.S. Quarterly Property Index.

pre-recession peak=100

During the financial crisis, commercial real estate asset values fell almost 31 percent from their pre-recession peak in the space of eight quarters, according to the MSCI U.S. Quarterly Property Index. But how have they fared since then? The answer largely depends on geography.

At the national level, it took until the third quarter of 2014 for assets to regain what they had lost, but asset values have continued to climb and, as of the end of the third quarter 2018, they were 25 percent higher than their pre-recession peak. However, the national average masks considerable regional variation. For example, in Denver and San Francisco, asset values are 47 percent and 55 percent higher than they were before the recession, while in Washington, D.C., and Chicago, asset values are only 11 percent and 10 percent up on their pre-recession high point. Houston is also an outlier, as the only major metropolitan area to have experienced asset value falls in the last few years, thanks to the end of the commodity boom. However, the metro is still 22 percent above the pre-recession peak.

You must be logged in to post a comment.