UK Crises Created Opportunities in Non-GBP-Denominated Currencies

Foreign currency denominated returns in the MSCI UK Monthly Property Index made during the post-event troughs significantly outperformed a GBP-denominated investment over similar periods.

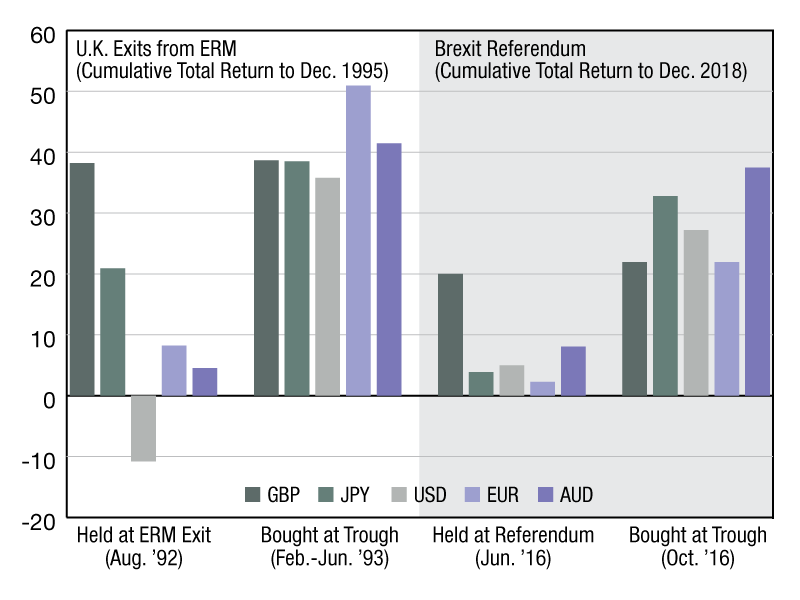

comparison of total returns before and after the Brexit referendum and Black Wednesday

International investors who use a foreign currency to buy real estate or property index funds might unwittingly take on foreign-exchange exposure. To demonstrate the currency risk faced by cross-border property investors, we examine the total returns of the MSCI UK Monthly Property Index in the periods before and after both the Brexit referendum and Black Wednesday—in local and foreign currency denominated terms.

After both major market-moving events, the MSCI UK Monthly Property Index’s total returns recovered quickly following the initial shock—but only for holders of the GBP-denominated index investment. For cross border investors, the two events’ impacts were significantly more negative.

Of course, currency exposure cuts both ways for cross-border real estate investors with the volatility opening up potential buying opportunities. Foreign currency denominated returns in the MSCI UK Monthly Property Index made during the post-event troughs significantly outperformed a GBP-denominated investment over similar periods.

You must be logged in to post a comment.