French Property Returns Lowest Since GFC in 2020

French property recorded a total return of 3.2 percent p.a. at December 2020, according to the MSCI France Annual Property Index.

All Property; Standing Investments

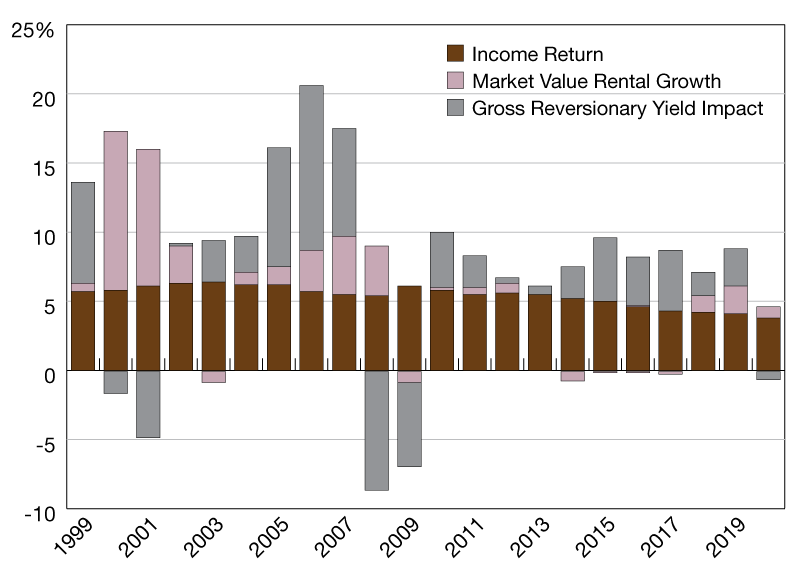

French property recorded a total return of 3.2 percent p.a. at December 2020, according to the MSCI France Annual Property Index. While this marked a sharp decline from the 8.4 percent recorded in 2019, the 2020 return remained well above the low of -1.5 percent recorded during the Global Financial Crisis.

The 2020 total return comprised an income return of 3.8 percent (down 30bps from December 2019) and a capital growth of -0.6 percent. It was the first negative capital growth recorded by the index since 2009 as the reversionary yield weakened on an all property level. Sector level results for the French real estate market in 2020 were mixed.

The industrial (+12.3 percent) and residential (+6.5 percent) sectors outperformed as positive sentiment reflected in a returns-enhancing yield impact. Meanwhile, retail (-3.6 percent) and hotels (-5.4 percent), both hard hit by the effects of the COVID-19 pandemic, recorded negative rental growth. Offices delivered a positive return overall, but location proved a key differentiator as Paris City assets outperformed those further afield.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.