Location Within Gateway Cities Mattered

Over the 10-year period to June 2020, these prime locations within the global cities all produced superior capital growth when compared to the rest of the city.

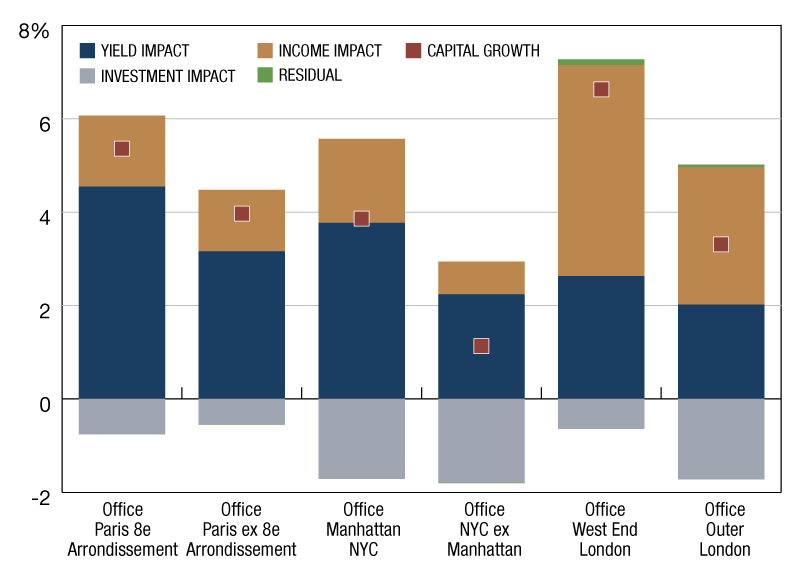

Annualized returns, 10 years to June 2020

Global gateway cities New York, Paris, Tokyo and London were top-ranked in terms of office sector purchase activity from 2001 to 2019 (24.6 percent by value), according to the MSCI Global Annual Property Index. But has their long-term investment performance justified this?

For the 10 years ended June 2020, offices in global cities did deliver a higher total return—largely driven by capital growth. But the components of the capital growth matter. A market’s ability to attract capital flows may result in yield compression, which in turn underpins capital growth. However, when yield compression occurs in the absence of sustained fundamental income growth, it could, over time, lead to artificially high asset prices.

A recent MSCI blog shows that global gateway cities’ higher capital growth comprised both higher yield compression and higher income growth. But cities are complex, and capital flows and investment returns are not always evenly spread within their borders. Even in the context of a city-focused strategy, however, institutional capital could be more focused on narrowly defined geographies like Manhattan, Paris’s eighth arrondissement or London’s West End.

Over the 10-year period to June 2020, these prime locations within the global cities all produced superior capital growth when compared to the rest of the city. In all three examples, these areas received a larger portion of their capital growth from fundamental property-income growth as a result of a strong occupier market. But they also benefited more from yield compression— meaning they became more expensive on a relative basis. But what could COVID-19 mean for these locations in the future?

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.