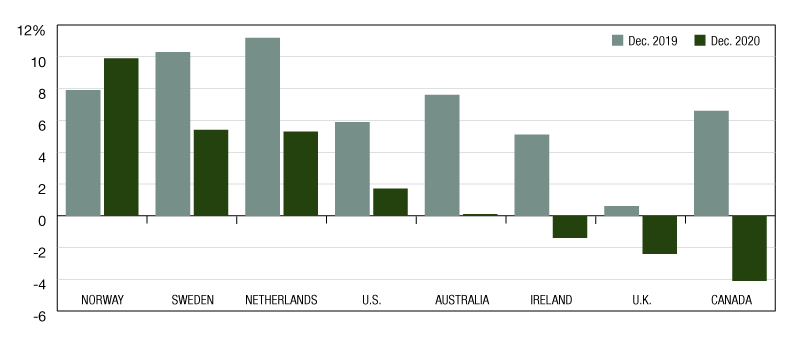

Norwegian Property up 200bps as Returns Dipped Elsewhere

Norwegian real estate returns improved 200bps to 9.9 percent in 2020, in contrast to most global markets.

Global Total Returns; Standing Investments; Local Currency

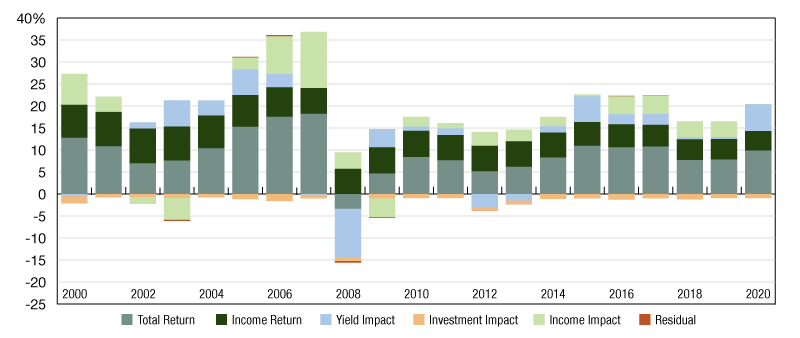

Norway Annual Property Index; All Property; Return Decomposition

Norwegian real estate returns improved 200bps to 9.9 percent in 2020, in contrast to most global markets. In 2020, the total return of the MSCI Norway Annual Property Index comprised an income return of 4.4 percent and a capital growth of 5.2 percent.

Globally, increased work-from-home combined with lower economic activity had a negative impact on the demand for office property which put downward pressure on rentals and returns as a consequence. However, Norwegian office property bucked this trend as it posted its best return since 2007 notwithstanding the headwinds created by the COVID-19 pandemic.

Office property (68 percent of the MSCI Norway Annual Property Index by value), benefitted from positive yield compression as the sector’s underlying fundamentals remained healthy through 2020. At December 2020, the office vacancy rate was 4.7 percent of market rent (only +10bps from 2019) while bad debts was well below its long term average when viewed as a percentage of gross rental.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.