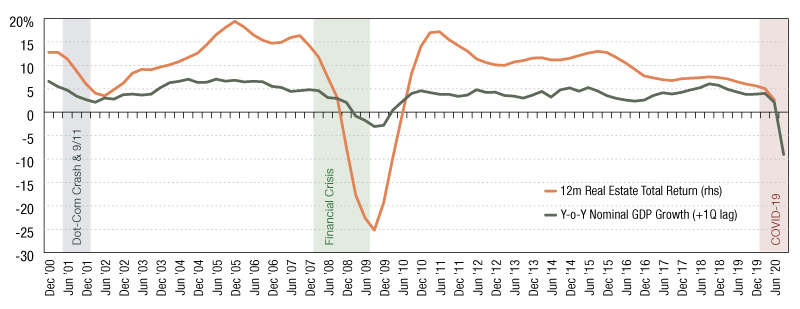

U.S. GDP Growth and Property Returns

Over the first six months of 2020, total returns according to the MSCI/PREA U.S. ACOE Quarterly Property Fund Index have already softened.

MSCI/PREA U.S. ACOE Quarterly Property Index

U.S. commercial real estate returns have fluctuated with broader economic activity over the past 20 years. With the U.S. economy recording its worst quarterly contraction in living memory during Q2 2020, this could have implications for real estate investors.

Over the first six months of 2020, total returns according to the MSCI/PREA U.S. ACOE Quarterly Property Fund Index have already softened compared to the last six months of 2019. The slowdown has been particularly acute for retail, hotel and leisure assets where travel restrictions and social distancing have had a more immediate impact. However, real estate performance has also historically been more volatile and lagged GDP growth meaning that the effects of the fall in GDP growth in Q2 may take more time to flow through to real estate.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.