Returns for the MSCI Italy Annual Property Index slowed across all sectors in 2020

On an All Property level, a total return of 2.7 percent was recorded for the year which was down from 5.5 percent in 2019.

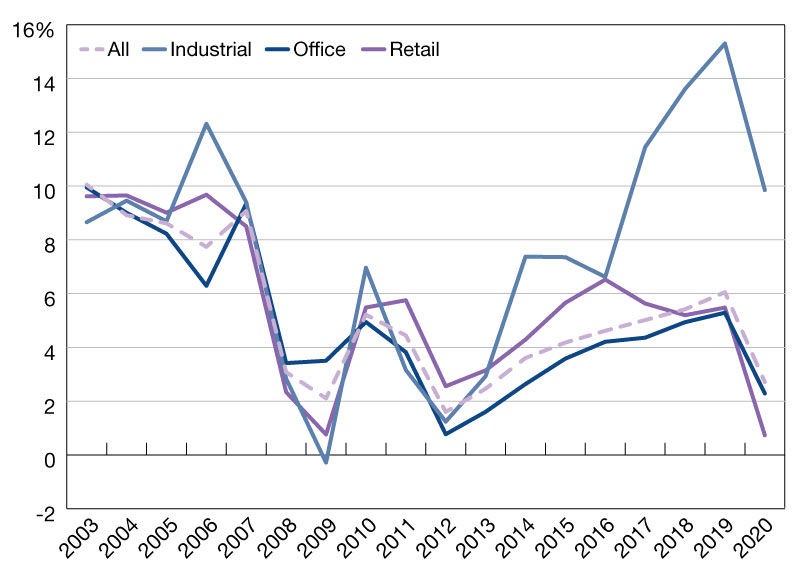

Total Return by Sector

On an All Property level, a total return of 2.7 percent was recorded for the year which was down from 5.5 percent in 2019. Retail was the worst—performing of the major property sectors, at 0.7 percent, amid a widening dispersion of returns—typical of market turning points.

While the average retail total return remained positive, the sector’s returns ranged from -11.8 percent to 4.0 percent from the 25th to 75th percentiles.

Industrial property was the top performing sector for the seventh year in a row with a return of 9.9 percent in 2020. This is despite the sector recording the largest deceleration in return after posting an all-time high of 15.3 percent in 2019.

Industrial’s dominance in 2020 was such that its lowest-quartile return of 7.4 percent exceeded other sectors’ top quartiles. In saying that, bright spots could be found in the distributions of selected submarkets—showing the value of varied segmentations and looking beyond the headline returns.

While the office sector recorded a return of 2.1 percent at the 75th percentile, office submarkets in central Milan produced returns that were comparable to the average industrial asset.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.