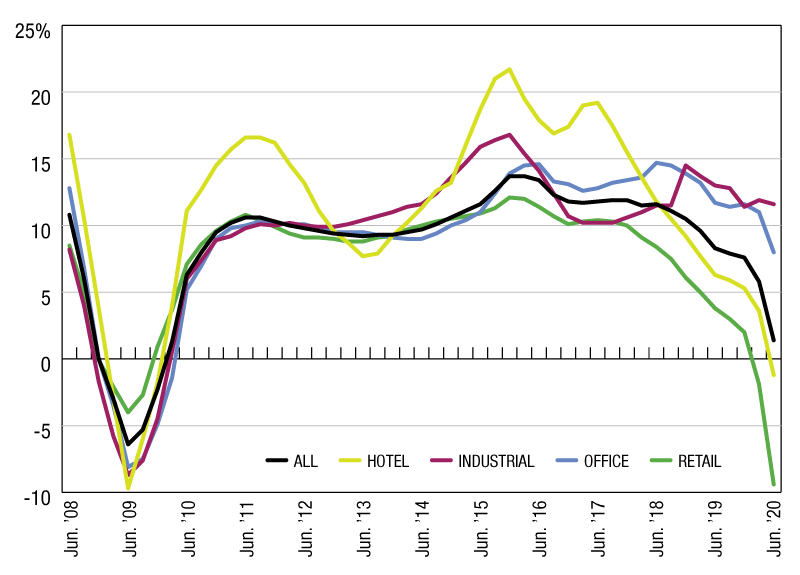

Australia Property Returns Lower as Retail and Industrial Returns Further Dislocate

Australian property returns slowed to -2.5 percent in the second quarter of 2020—the lowest quarterly return since 2009.

Total Return

Australian property returns slowed to -2.5 percent in the second quarter of 2020—the lowest quarterly return since 2009, according to the Property Council of Australia/MSCI Australia Annual Property Index. While this resulted in the annual return slowing to 1.4 percent, underlying sector returns varied significantly. Industrial property returned 11.6 percent on an annual basis, while the retail sector, hard-hit by lockdown restrictions, slowed to a new low of -9.4 percent. The returns of industrial and retail subtypes started diverging in 2018—a trend that the COVID19 crisis accelerated, as income from retail assets came under considerable stress. For the second quarter of 2020, the retail sector’s quarterly net operating income fell by 65.1 percent compared to the same quarter the year before. Super and major regional malls saw the largest decline at -78.3 percent, as the country’s large format malls proved especially hard-hit by lockdown regulations and social distancing.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.