Dividend Yield

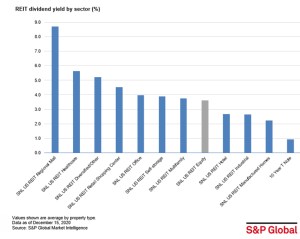

REIT Dividend Yield by Sector

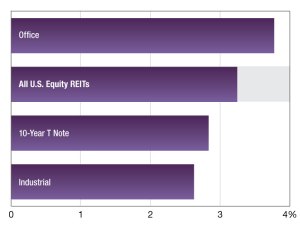

Manufactured homes recorded the lowest average dividend yield at 2.23 percent, according to S&P Global.

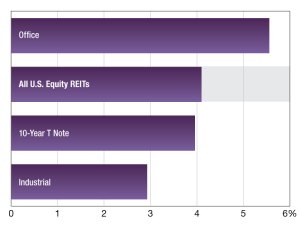

2020 REIT Dividend Yields

The regional mall REIT sector recorded the highest one-year average dividend yield among the group.

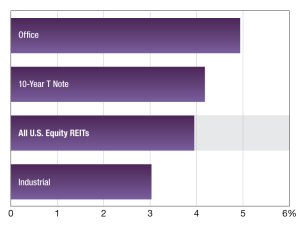

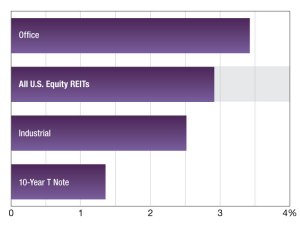

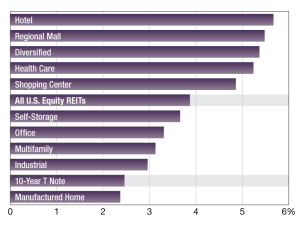

2019 REIT Dividend Yields

The Health Care REIT sector posted the highest one-year average dividend yield among the group.

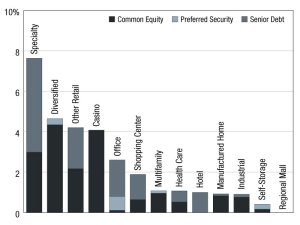

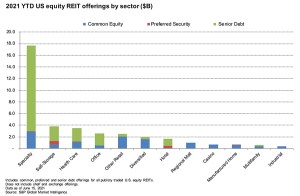

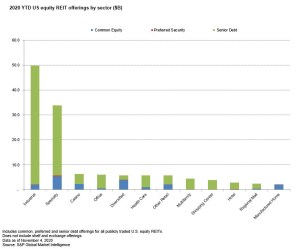

2020 REIT Offerings by Sector

Industrial and specialty REITs dominated the offerings, according to S&P Global Market Intelligence.