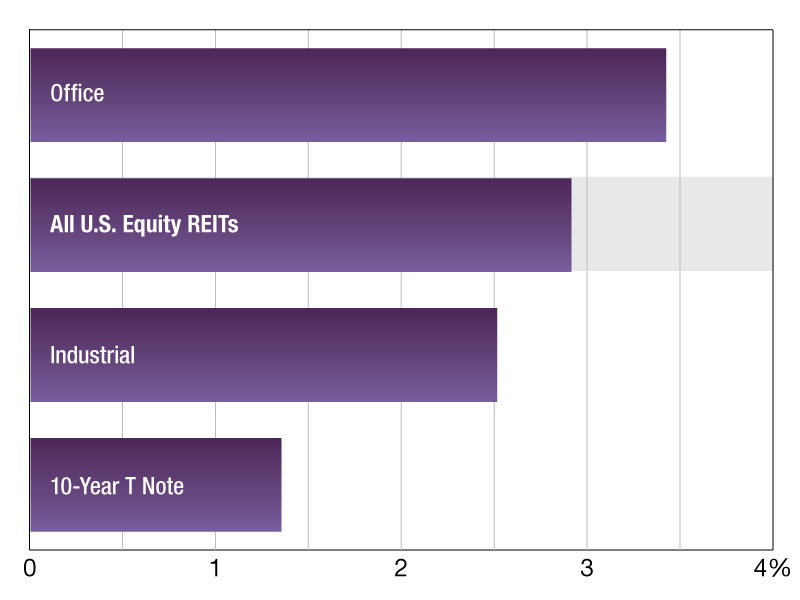

2021 Commercial REIT Dividend Yields

As of Nov. 2, the office REIT sector recorded the highest one-year average dividend yield among this group, according to S&P Global Market Intelligence.

Values shown are average by property type. As of Nov. 2, 2021.

Source: S&P Global Market Intelligence

As of Nov. 2, 2021 publicly traded U.S. equity REITs posted a one-year average dividend yield of 2.9 percent.

The office REIT sector recorded the highest one-year average dividend yield among this group, at 3.4 percent, outperforming the broader Dow Jones Equity All REIT Index by 0.5 percentage points.

The industrial REIT sector followed with a one-year average dividend yield of 2.5 percent, outperforming the 10-Year T-Note by 117 basis points.

Winzen Matamorosa is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Nov. 19, 2021

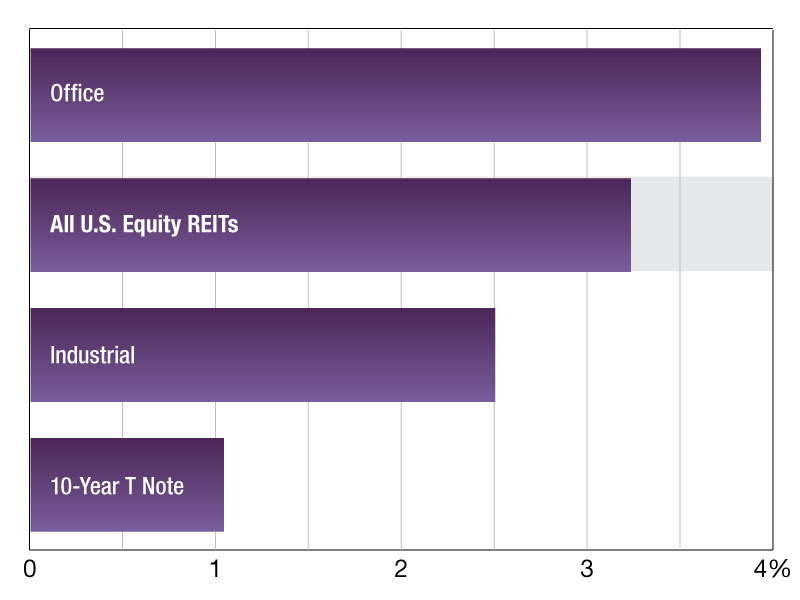

Values shown are average by property type. As of Jun. 1, 2021.

Source: S&P Global Market Intelligence

As of June 1, publicly traded U.S. equity REITs posted a one-year average dividend yield of 3.2 percent.

The office REIT sector recorded the highest one-year average dividend yield among this group, at 3.9 percent, outperforming the broader SNL U.S. REIT Equity Index by 0.71 percentage points. The industrial REIT sector followed with a one-year average dividend yield of 2.5 percent, outperforming the 10-Year T-Note by 146 basis points.

George Ziglar is an Associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

If you are interested to learn more about the products and services available within S&P Global Real Estate data, please visit us here.

—Posted on Jun. 29, 2021

You must be logged in to post a comment.