2021 REIT Offerings by Sector

Specialty and diversity REITs are the most active capital raisers, according to S&P Global Market Intelligence.

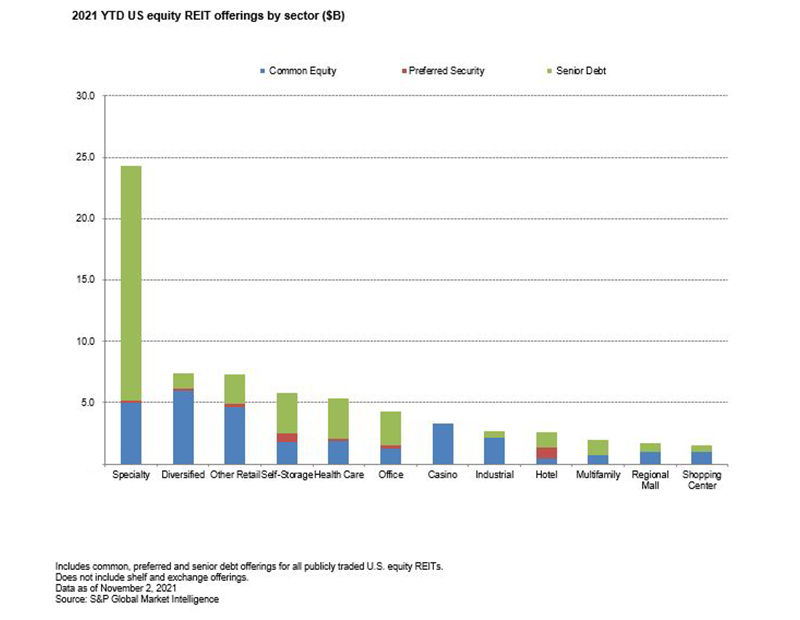

As of Nov 2, publicly traded U.S.equity REITs raised approximately $69.47 billion through capital offerings. Senior debt offerings accounted for 52 percent of total capital raised, amounting to $36.38 billion, followed by common and preferred issuances which totaled $30.3 billion and $2.79 billion, respectively.

Specialty and diversified REITs topped the charts among the REIT property sectors, aggregating $31.62 billion over 78 senior debt, common and preferred stock offerings. Specialty REIT American Tower Corp. raised $2.42 billion through one common equity offering, while SBA Communications Corp. raised $1.50 billion in senior debt offering. Crown Castle International Corp. ranked third with a total of $1.25 billion through one senior debt offering.

Winzen Matamorosa is an associate in the real estate client operations department of S&P Global Market Intelligence.

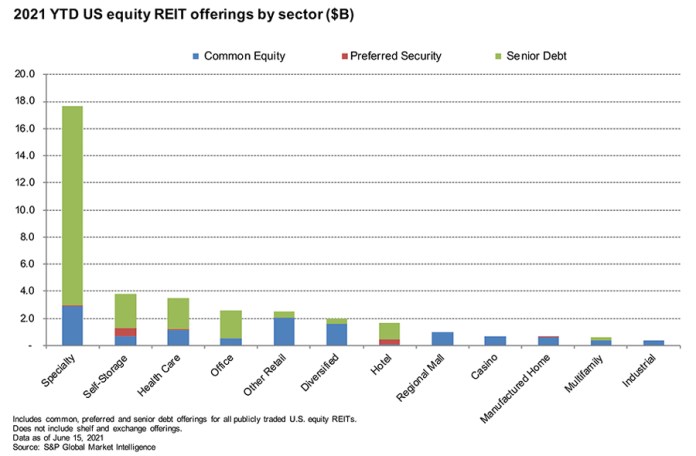

As of June 15, 2021, publicly traded U.S. equity REITs raised approximately $37.49 billion through capital offerings. Senior debt offerings accounted for 64 percent of total capital raised, amounting to $24.01 billion, followed by common and preferred issuances, which totaled $12.33 billion and $1.15 billion, respectively.

Specialty and self storage REITs topped the charts among the REIT property sectors, aggregating $21.49 billion over 44 senior debt, common and preferred stock offerings. Of these companies, specialty REIT American Tower Corp. raised $6.26 billion through senior debt and a follow-on equity offering, while Equinix Inc. raised $3.93 billion in senior debt offerings. Crown Castle International Corp. ranked third, with senior debt offerings that raised $3.25 billion.

George Ziglar is an associate in the Real Estate Client Operations Department of S&P Global Market Intelligence.

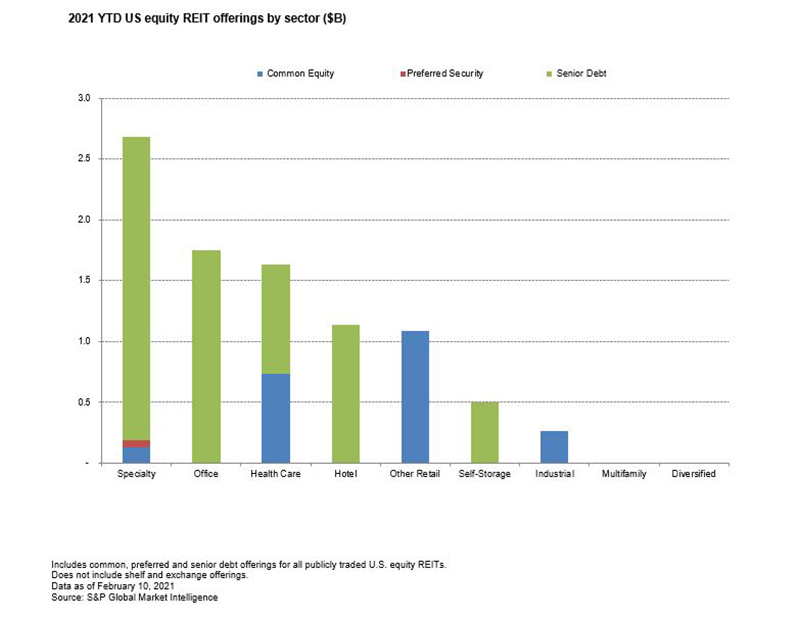

As of Feb. 10, 2021, publicly traded U.S. equity REITs raised approximately $9.07 billion through capital offerings. Senior debt offerings accounted for 75 percent of total capital raised, amounting to $6.79 billion, followed by common and preferred issuances, which totaled $2.23 billion and $0.05 billion, respectively.

Specialty and office REITs topped the charts among the REIT property sectors, aggregating $4.43 billion over nine senior debt, common and preferred stock offerings. Specialty REIT SBA Communications Corp. raised $1.50 billion through one senior debt offering, while Crown Castle International Corp. raised $1 billion in senior debt offering. Gladstone Land Corp. ranked third with a total of $0.09 billion through one common and preferred equities.

Diana Rose Barrun is a senior associate in the Client Operations department of S&P Global Market Intelligence.

You must be logged in to post a comment.