Diana Rose Barrun

2020 REIT Results

Among the sectors, Diversified REITs had the highest average AFFO payout ratio estimate for the quarter.

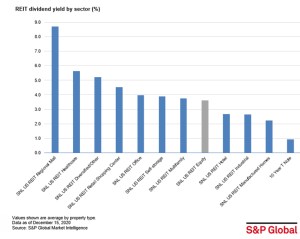

REIT Dividend Yield by Sector

Manufactured homes recorded the lowest average dividend yield at 2.23 percent, according to S&P Global.

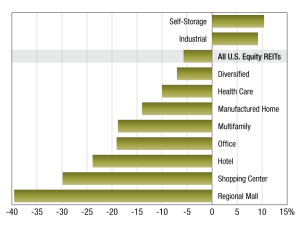

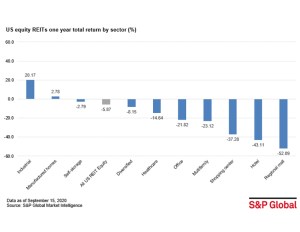

2020 REIT Returns

As of Dec. 1, 2020, publicly traded U.S. equity REITs posted a -5.7 percent one-year total return.

2020 REIT Trading Trends

As of Oct. 30, 2020, publicly listed U.S. equity REITs traded at a 19.3 percent median discount to estimated net asset value.

2020 REIT Values

As of Sept. 30, the manufactured homes sector led all publicly traded U.S. equity REIT sectors in terms of the funds from operations multiple for the last 12 months.

2020 REIT Total Returns

Hotel and retail REITs dragged down year-over-year returns for the sector.

2020 REIT Results

Among the sectors, multifamily REITs had the highest average AFFO payout ratio estimate for the third quarter of 2020, at 90.5 percent.

2020 REIT Dividend Yields

The regional mall REIT sector recorded the highest one-year average dividend yield among the group.

2019 REIT Values

The manufactured homes sector led all publicly traded U.S. equity REIT sectors in terms of the last 12 months.