2019 REIT Values

The manufactured homes sector led all publicly traded U.S. equity REIT sectors in terms of the last 12 months.

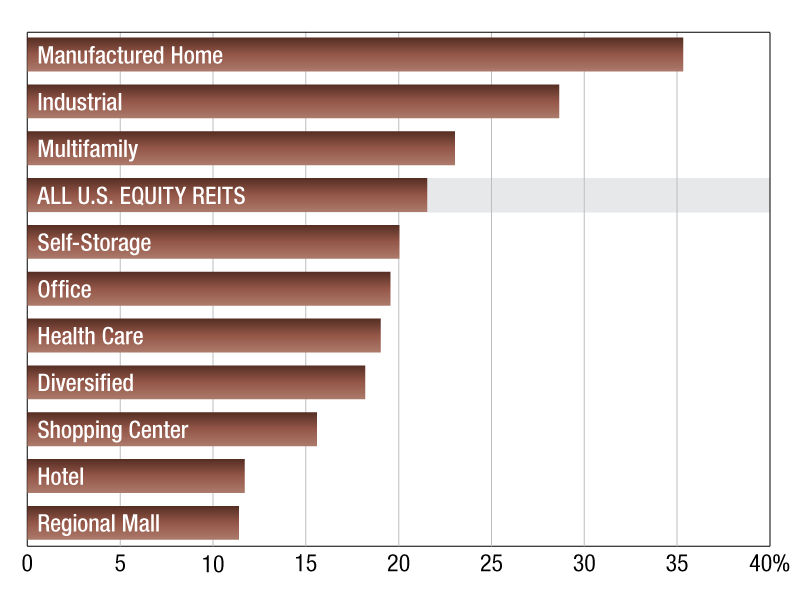

SNL U.S. REIT Index Price/LTM FFO [x]

As of Dec. 2, 2019, the manufactured homes sector led all publicly traded U.S. equity REIT sectors in terms of the last 12 months funds from operations (LTM FFO) multiple. The sector posted a 35.33x LTM FFO multiple, outperforming the SNL US REIT Equity Index by 13.8 percentage points. The industrial and multifamily REIT sectors followed with multiples of 28.65x and 23.03x, respectively. The regional mall sector ranked last with a 11.39x price to LTM FFO.

Among the REITs focused on manufactured homes, Equity Lifestyle Properties Inc. had the highest P to LTM FFO multiple of 35.5x, and a share price of $73.21.

New Senior Investment Group Inc., a Healthcare REIT, had a 49.2x LTM FFO multiple, the highest among the publicly traded U.S. equity REITs, and its stock traded at $7.87.

Diana Rose Barrun is an associate for the real estate client operations department of S&P Global Market Intelligence.

—Posted on Dec. 16, 2019

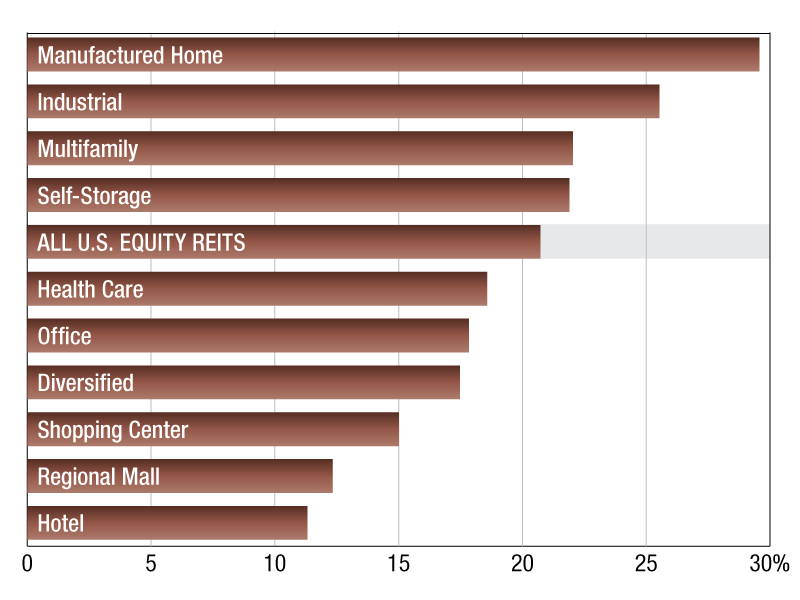

SNL U.S. REIT Index Price/LTM FFO [x]

As of June 28, 2019, the Manufactured Homes sector led all publicly traded U.S. Equity REIT sectors in terms of the last 12 months funds from operations (LTM FFO) multiple. The sector posted a 29.57x LTM FFO multiple, outperforming the SNL US REIT Equity Index by 8.8 percentage points. The Industrial and Multifamily REIT sectors followed with multiples of 25.53x and 22.04x, respectively. The Hotel sector ranked last with a 11.31x price to LTM FFO. Among the REITs focused on Manufactured Homes, UMH Properties Inc. had the highest multiple of 47.2x, and ended June with a share price of $12.41. CIM Commercial Trust Corp., an Office REIT, had a 60.2x LTM FFO multiple, the highest among the publicly traded U.S. Equity REITs, and its stock traded at $20.62 as of June 28.

James Mathieu manages the real estate client operations department of S&P Global Market Intelligence.

—Posted on July 24, 2019

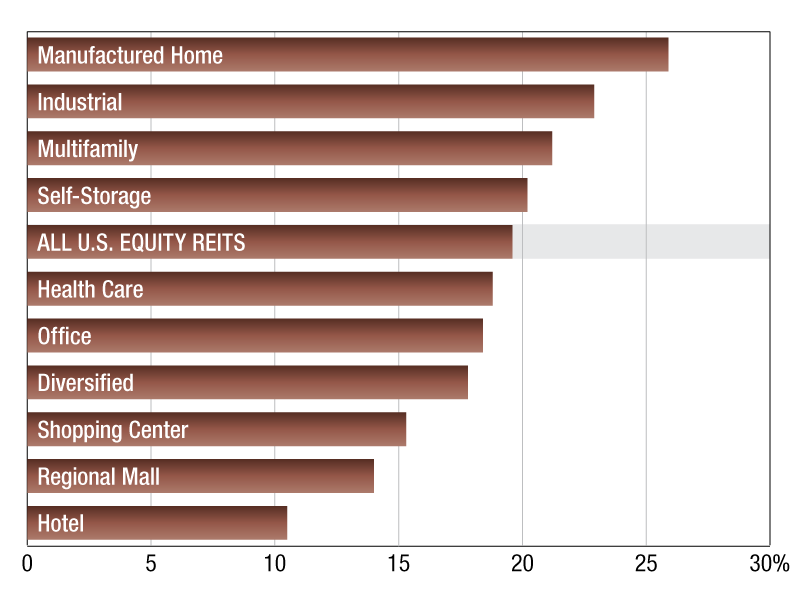

SNL U.S. REIT Index Price/LTM FFO [x]

As of Feb. 1, 2019, the Manufactured Homes sector led all publicly traded U.S. Equity REIT sectors in terms of the last 12 months funds from operations (LTM FFO) multiple. The sector posted a 25.9x LTM FFO multiple, outperforming the SNL US REIT Equity Index by 6.3 percentage points. The Industrial and Multifamily REIT sectors followed with multiples of 22.9x and 21.2x, respectively. The Hotel sector ranked last with a 10.5x price to LTM FFO.

Among the REITs focused on Manufactured Homes, Equity LifeStyle Properties Inc. had the highest multiple of 27.0x, and began February with a share price of $105.7.

Innovative Industrial Properties Inc., an Industrial REIT, had a 67.4 LTM FFO multiple, the highest among the publicly traded U.S. Equity REITs, and traded at $63.3 per share as of Feb. 1. Equity Commonwealth followed with a 55.3x price to LTM FFO while trading at $32.1 per share.

The Multifamily REIT sector had a 21.2x LTM FFO multiple as of February 1. Among the Multifamily REITs, Investors Real Estate Trust was on top of the list with a 40.8x LTM FFO multiple. Next was NexPoint Residential Trust Inc. with a 25.1x LTM FFO multiple. Preferred Apartment Communities Inc. was at the bottom of the list with a 11.8x LTM FFO multiple.

Carter Phillips is an analyst in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Feb. 14, 2019

You must be logged in to post a comment.