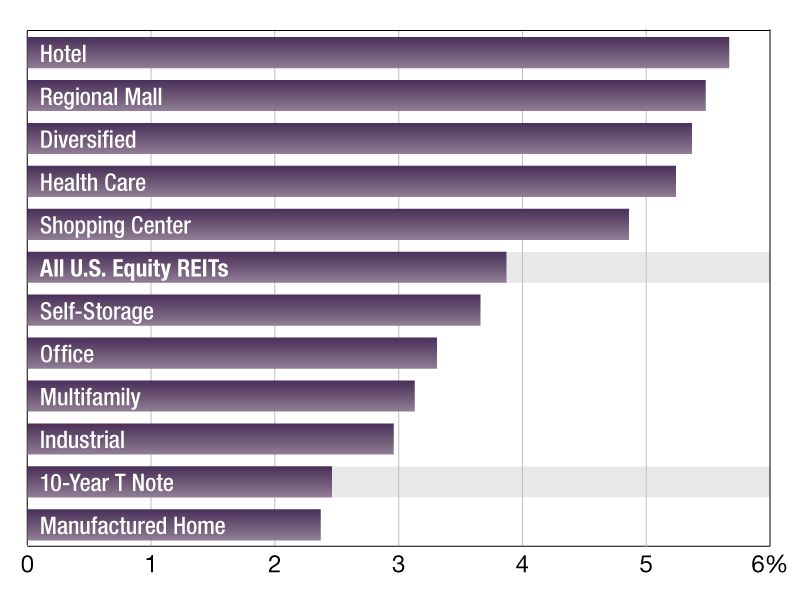

2019 REIT Dividend Yields

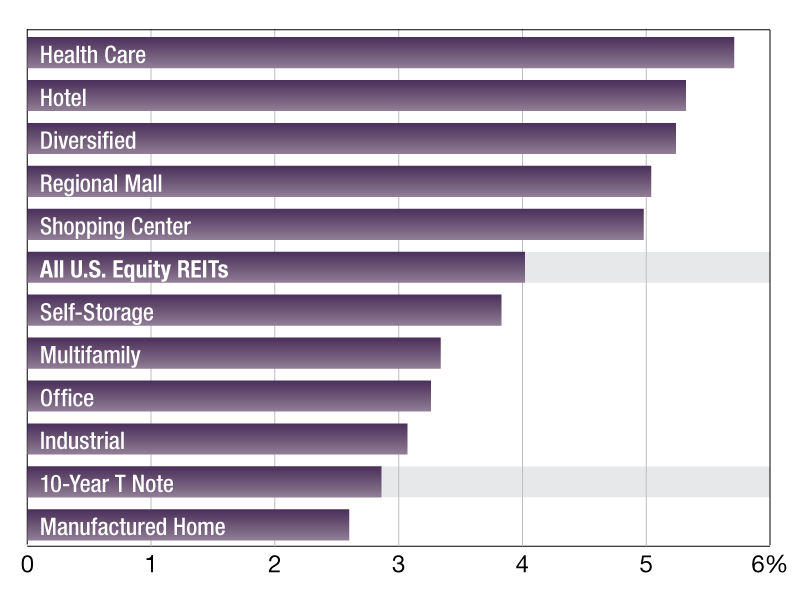

The Health Care REIT sector posted the highest one-year average dividend yield among the group.

Values shown are average by property type. As of Sep. 30, 2019.

Source: S&P Global Market Intelligence

As of September 30, publicly traded U.S. equity REITs had a one-year average dividend yield of 3.9 percent.

The hotel REIT sector posted the highest one-year average dividend yield among the group, at 5.7 percent, outperforming the broader SNL U.S. REIT Equity Index by 1.8 percentage points. The regional mall and diversified sectors followed with 5.5 percent and 5.4 percent one-year average dividend yields, respectively.

On the other end of the spectrum, the manufactured homes sector logged the lowest average dividend yield at 2.4 percent, trailing the 10-Year T-Note by nine basis points.

Aftab Alam is a senior associate in the real estate client operations department of S&P Global Market Intelligence.

—Posted on Oct. 24, 2019

As of April 30, publicly traded U.S. Equity REITs had a one-year average dividend yield of 4.0 percent. The Health Care REIT sector posted the highest one-year average dividend yield among the group, at 5.7 percent, outperforming the broader SNL U.S. REIT Equity Index by 1.7 percentage points. The Hotel and Diversified sectors followed with 5.3 percent and 5.2 percent one-year average dividend yields, respectively.

On the other end of the spectrum, the Manufactured Homes sector logged the lowest average dividend yield at 2.6 percent, trailing the 10-Year T-Note by 26 basis points.

Carter Phillips is an analyst in the real estate client operations department of S&P Global Market Intelligence.

—Posted on May 20, 2019

You must be logged in to post a comment.