Newsletter Graph

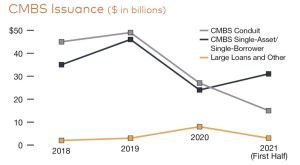

What’s Driving CRE Securitization

An update on the key trends shaping conduits, CLOs and other strategies.

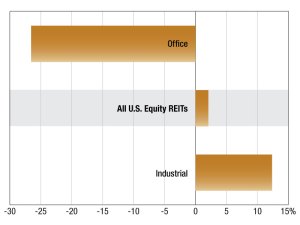

2021 REIT Trading Trends

The latest updates on the industrial and office sectors from S&P Global Market Intelligence

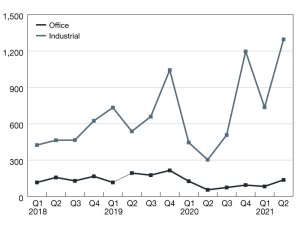

Commercial Borrowing Bounces Back in the Q2 2021

Originations for office properties increased 149 percent on an annual basis, according to MBA’s latest survey.

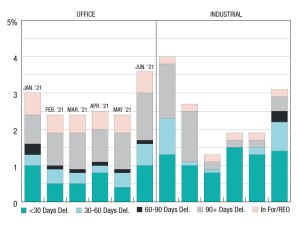

Office, Industrial Loan Performance Held Steady in June

Non-current rates inched higher for both, but remained relatively low, according to MBA’s latest survey.

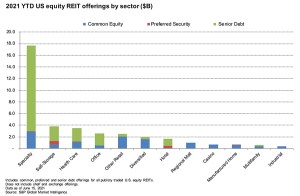

2021 REIT Offerings by Sector

Specialty and diversity REITs are the most active capital raisers, according to S&P Global Market Intelligence.

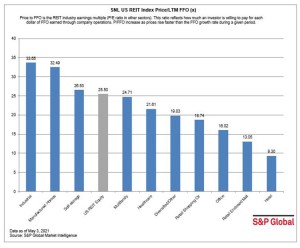

Industrial REITs Lead the Sector for FFO in April

The sector continues to lead the sector in terms of the last 12 months’ FFO multiple.

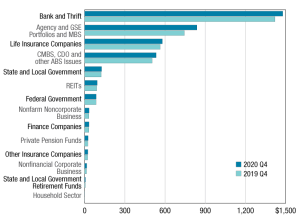

Commercial/Multifamily Mortgage Debt Rises at the End of 2020

Amid the pandemic and led by multifamily lending, mortgage debt outstanding closed 2020 higher than the pre-pandemic levels seen at the end of 2019.

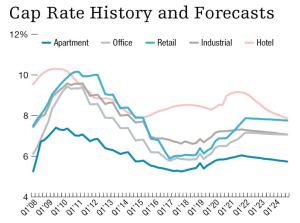

CRE Loan Maturities Cushioned by Willing Lenders

With yield-hungry investors and lenders competing for their business, owners of preferred assets will find refi options aplenty.

- « Previous

- 1

- …

- 3

- 4

- 5