Office, Industrial Loan Performance Held Steady in June

Non-current rates inched higher for both, but remained relatively low, according to MBA’s latest survey.

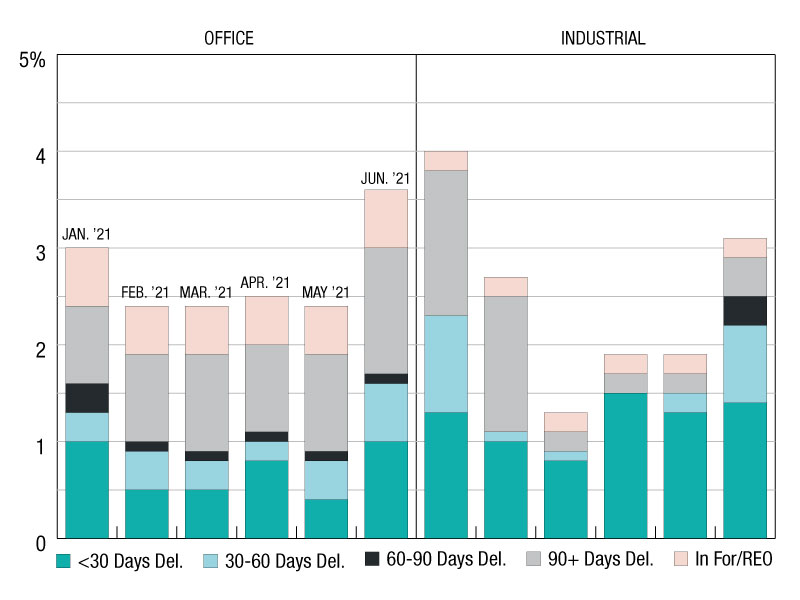

Delinquency Status; Share of Total Unpaid Principal Balance

Over the past year, the Mortgage Bankers Association’s (MBA) monthly CREF Loan Performance Survey has been a reliable source of data on how the COVID-19 pandemic has impacted the commercial mortgage loan performance of various property types and capital sources. In the latest release, the data show that delinquency rates for mortgages backed by commercial properties held steady.

For office and industrial, the picture was mixed last month. Non-current rates inched higher for both, but remained relatively low. Below is the breakdown last month by property type, and the accompanying chart shows the mostly steady performance for office and industrial since April 2020.

Non-current rates for other property types were at lower levels during the month. Of this, 3.1 percent of the balances of industrial property loans were non-current, up from 1.9 percent a month earlier. In addition, 3.5 percent of the balances of office property loans were non-current, up from 2.4 percent a month earlier.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.