Newsletter Graph

2022 Commercial REIT Results

Publicly traded equity REITs had an average Q3 AFFO payout ratio estimate of 72 percent, according to S&P Global Market Intelligence.

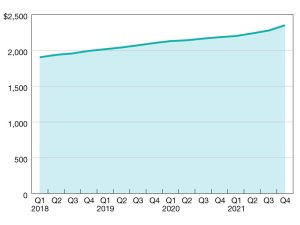

Commercial/Multifamily Mortgage Debt Outstanding Increased by $99.5 Billion in Second-Quarter 2022

The first half of 2022 saw more commercial and multifamily borrowing and lending than any previous January through June, according to MBA.

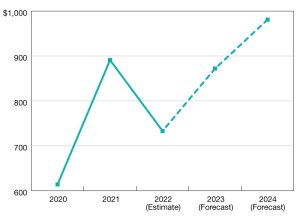

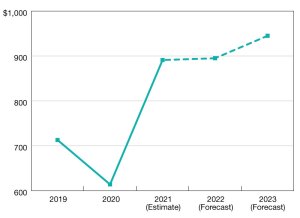

Higher Rates to Slow Commercial Lending in 2nd Half of 2022

Totals are expected to fall to $733 billion this year.

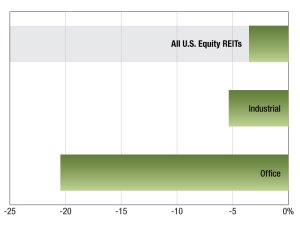

2022 REIT Returns

As of Aug. 4, the publicly traded U.S. equity REITs in the Dow Jones equity all REIT index posted a -3.5 percent total return.

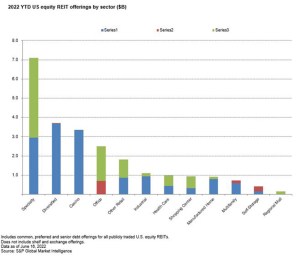

2022 REIT Offerings

YTD capital raising from S&P Global Market Intelligence.

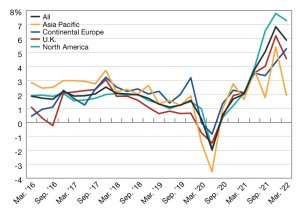

Property Funds Reported Strong Returns in Q1 2022

MSCI’s Global Quarterly Property Fund Index tracked the investment performance of 109 open-end real estate funds with a total gross asset value of USD $678 billion.

Commercial Lending to Hold Steady in 2022 Amidst Higher Rates, Economic Uncertainty

MBA anticipates almost $950 billion of total commercial real estate lending in 2023.

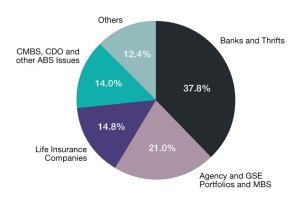

Commercial Mortgage Debt Outstanding Jumps to Record High in Q4

Commercial banks continue to hold the largest share of mortgages at $1.6 trillion, according to MBA’s recent survey.

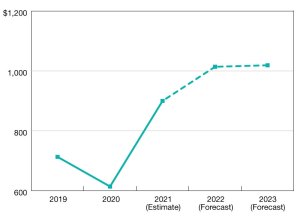

Lending to Hit Record $1 Trillion in 2022

Total mortgage borrowing and lending is expected to increase 13 percent, according to MBA’s latest forecast.

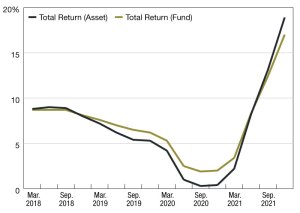

Global Property Fund Returns Underpinned by Industrial

In 2021, the MSCI Global Quarterly Property Fund Index recorded its highest annual return in at least 13 years.