Higher Rates to Slow Commercial Lending in 2nd Half of 2022

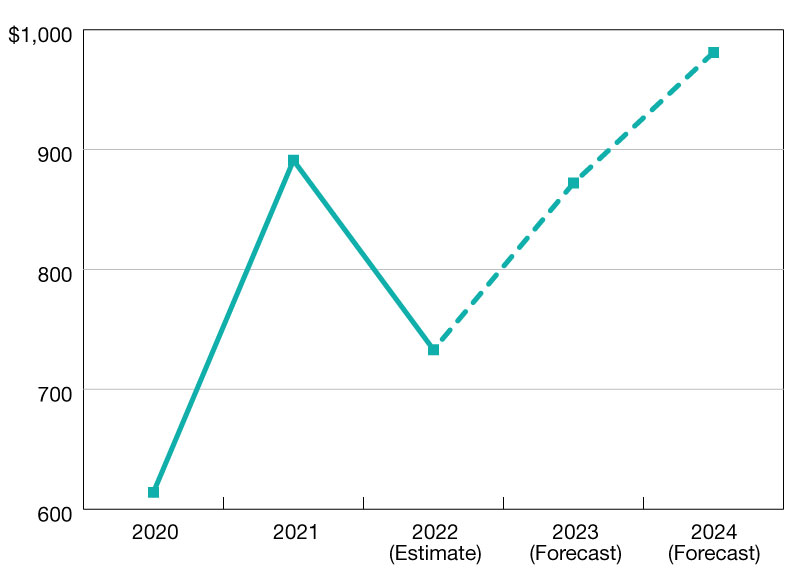

Totals are expected to fall to $733 billion this year.

$ in billions

Commercial and multifamily borrowing and lending activity is shaping up to be a tale of two halves in 2022.

After a record start to the year, MBA expects that the rise in rates, ongoing uncertainty about supply and demand balances among some property types, and concerns about the direction of the economy will suppress new loan originations in the second half of the year.

According to an updated baseline MBA forecast, total mortgage borrowing and lending is now expected to fall to $733 billion this year, down 18 percent from 2021 totals ($891 billion).

The direction of the economy, which remains uncertain, will be a major driver of the magnitude and timing of market changes. Should the economy enter a recession, which–if it were to happen–would most likely come in the first half of 2023, commercial borrowing and lending would likely be further constrained.

The good news? Most commercial real estate market fundamentals remain strong, with significant increases in the incomes and values of many properties in recent years. These factors are why MBA expects–as of now–that loan demand will begin to bounce back next year. MBA anticipates borrowing and lending will rebound in 2023 to $872 billion in total commercial real estate lending.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.