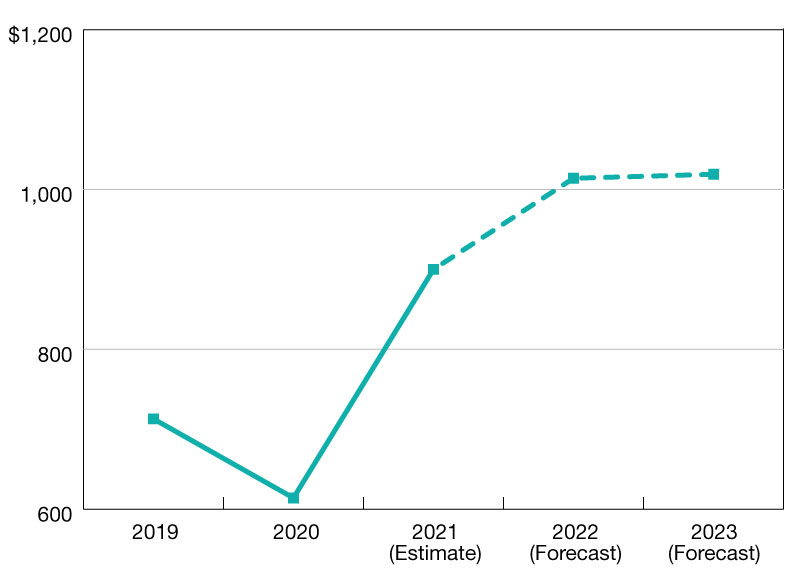

Lending to Hit Record $1 Trillion in 2022

Total mortgage borrowing and lending is expected to increase 13 percent, according to MBA’s latest forecast.

$ in billions

There was an impressive 79 percent year-over-year jump in originations in fourth-quarter 2021, completing what MBA estimates was total volume of $900 billion for the year. 2022 is forecasted to be even higher.

Total mortgage borrowing and lending is expected to break $1 trillion for the first time, a 13 percent increase from 2021’s estimated volume of $900 billion. This is according to MBA’s new forecast released last month at our 2022 Commercial/Multifamily Finance Convention and Expo.

Commercial real estate lending volumes are closely tied to the values of the underlying properties. In 2021 those values rose by more than 20 percent, and those increases will fuel further demand for mortgage debt in the coming years. Continued increases in property incomes, and stability in the ways investors value those incomes, should also support solid demand for mortgage capital, even in the face of modest increases in interest rates.

One important item to note. MBA’s commercial real estate finance (CREF) forecast is updated this year to target total commercial real estate lending. In past years the forecast targeted lending by dedicated lenders, which excluded mortgages made by many smaller and midsized depositories. The lending volumes in this year’s forecast incudes those institutions.

For the office and industrial sectors, the final three months of 2021 show evidence of continued strong lending activity in 2022. Fourth-quarter originations jumped 122 percent and 113 percent (on an annual basis) for office and industry properties, respectively.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.