Net Lease Cap Rates Set Records

Cap rates for single-tenant retail properties hit an all-time low in the first quarter as buyers chase these net lease assets.

By Poonkulali Thangavelu

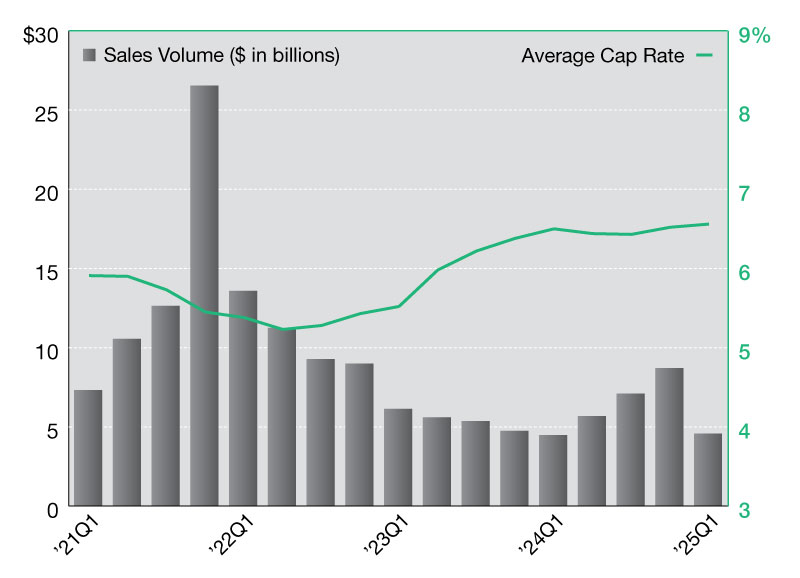

Net lease retail investment is hitting new lows, but that’s a sign of its high esteem among investors. During the first quarter, median cap rates for single-tenant retail properties dropped to 6.18 percent, setting a record, according to a report published in April by The Boulder Group. That represents a decline of 7 basis points from the previous quarter and a 22-basis-point decline year over year.

By comparison, the median cap rate for single-tenant office properties was 7.2 percent during the first quarter, a 20-basis-point increase. In the net lease industrial sector, cap rates ended the first quarter at 7.1 percent, marking a 44-basis-point decline.

“The macro picture is that there is an aging demographic that is looking for higher yield,” explained Randy Blankstein, president of Northbrook, Ill.-based The Boulder Group. “They can’t find it in the bond market or elsewhere, and net lease offers attractive yields in comparison.”

Single-tenant retail is also getting stepped-up attention from the advisory side of the business. In March, SRS Real Estate Partners announced the launch of a national net lease platform led by Matthew Mousavi and Patrick Luther, formerly of Faris Lee Investments. Based in Newport Beach, Calif., Mousavi and Luther are doing double duty as co-heads of Southern California investment sales for SRS.

Steady demand, less supply

With cap rates at historic lows and no clear signals from the Federal Reserve on possible hikes in the benchmark rate for 10-year Treasuries, many investors have been in wait-and-watch mode in recent months. While high-net-worth individuals and 1031 exchange investors remain aggressive, institutional investors, such as REITs, are more circumspect. Plummeting cap rates make it difficult for institutional investors to achieve target returns with net lease retail properties. That, in turn, has helped put the brakes on transaction volume.

A new Chick-Fil-A in Atlanta’s West Midtown recently traded for $4.8 million this year, a record for the quick-service restaurant chain.

At the same time, the supply of single-tenant retail product has declined slightly. During the third quarter of 2015, some 3,497 properties were on the market; by the first quarter of 2016, that number had dwindled to 3,029, The Boulder Group reported.

Even among net lease retail niches, cap rates vary considerably, from about 4 percent to 7 percent. Big-box stores and office supply stores are generally found at the higher end, because some investors view them as susceptible to competition from e-commerce.

On the lower end, hovering in the 4 percent range, are cap rates for necessity-oriented niches such as drugstores, convenience stores and restaurant brands like McDonald’s, Chick-Fil-A and Starbucks. For CVS stores built between 2011 and 2016, median asking cap rates are 5 percent; 7-Eleven stores from the same period fetch 4.63 percent cap rates, and McDonald’s restaurants command a median 3.88 asking rate, The Boulder Group reported.

Earlier this year, a 1031 exchange buyer paid $4.8 million for a newly built Chick-Fil-A in Atlanta’s West Midtown neighborhood. The deal involved a 20-year ground lease and no landlord responsibilities. Of note, the sale also set a record for a single-tenant Chick-Fil-A property, according to CoStar.

And while cap rates for net-leased bank properties remain low, generally under 5 percent, they are less sought after than other categories. It can be relatively difficult to re-tenant these properties because of their specialized features, like vaults.

“Properties that have the three core pillars of location, credit and lease term are being traded at the highest prices and super-low cap rates,” noted Daniel Hoogesteger, a Santa Monica, Calif.-based managing director with Sands Investment Group.

Short-term strategies

This new, triple-net-leased Family Dollar store in Augusta, Ga., recently traded for $1.5 million in a deal arranged by The Boulder Group.

In some cases, even net lease retail assets with short-term leases could trade at low cap rates, especially properties offering a combination of an attractive location and below-market rent. Since financing for such properties is often difficult to come by, they tend to attract cash buyers chasing yield.

To make properties with shorter-term leases more appealing to prospective investors, some owners are offering tenants a break on rent as an incentive to sign lease extensions. “Because of the lack of new assets, you’re seeing a lot of creative work being done with second-generation assets,” explained Ken Hedrick, managing director with Tulsa, Okla.-based Stan Johnson Co.

And while secondary and tertiary markets, with their lower barriers to entry, have generally recorded cap rates on the upper end of the curve in recent years, the difference between these smaller markets and the top 25 metros has narrowed. As a result, investor interest in the top markets is rising, Blankstein reported.

Market participants are also watching for the impact of consolidation, such as Carl Icahn’s purchase of Pep Boys and the pending Walgreens/Rite Aid and Staples/Office Depot mergers. A wave of store closings in the auto parts, drugstore and office supply niches could ripple through the market. That possibility, in turn, may make some buyers hesitate. Also on the radar: whether Walgreens’ planned deal for Rite Aid passes muster with federal regulators.

As Hedrick observed: “Many of these mergers and acquisitions can cause a momentary pause in the marketplace, until the dust settles and everyone understands the clear direction of the company post-merger, and also fully understands the credit story post-acquisition.”

You must be logged in to post a comment.