Market Update: DC Office Had a Steady 2022

Highlights of the capital region’s performance, based on CommercialEdge data.

Although still lagging some of the other gateway markets in terms of recovery from the pandemic, the Washington, D.C., office market continues to have a few aces up its sleeve. See below the relevant figures characterizing the metro’s evolution throughout 2022.

More than 8.5 million square feet of office space were under construction in the nation’s capital at the end of December, representing 2.1 percent of total stock, close to the national level (2.3 percent). However, the metro was surpassed by Boston (6.1 percent), San Francisco (4.3 percent) and Manhattan (3.2 percent).

Some 3.4 million square feet, or 40 percent of the total, entered the D.C.’s pipeline in 2022. The volume is 5.9 percent lower than the one recorded the previous year, when developers had broken ground on 3.6 million square feet.

READ ALSO: Developing Office in Turbulent Times

The year’s largest office project underway was Amazon’s HQ2. In March, Clark Construction placed the topmost beams on the two 22-story office towers, totaling more than 2.1 million square feet, that make up the first phase of the company’s second headquarters in Arlington, Va. Completion is expected later this year.

The Wharf. Image by Matthew Borkoski, courtesy of Hoffman-Madison Waterfront

Deliveries amounted to 2.7 million square feet or 0.7 percent of stock. Some of the largest additions to the metro’s inventory included:

- Marriott International’s headquarters in downtown Bethesda, Md. Developers Bernstein Cos. and Boston Properties broke ground on the 785,000-square-foot building in 2018. Designed by Gensler, the LEED Gold-certified property features 2,842 workspaces, 180 conference rooms and five levels of underground parking.

- The Wharf Phase 2. The second phase of the $3.6 billion, 3.5 million-square-foot development on the waterfront in Southwest Washington, D.C., brought The Wharf’s office space inventory to more than 1 million square feet. Hoffman-Madison Waterfront is the partnership behind the mixed-use project.

- Tysons Central, a 388,206-square-foot office building in Tysons, Va. Foulger-Pratt and USAA Real Estate started construction on the $200 million Gensler-designed tower in 2019 as part of the $750 million Tysons Central development taking shape west of downtown Washington, D.C.

Fluctuating office leasing activity

The District’s office leasing activity slightly improved throughout the year, although the third and fourth quarters witnessed smaller deals and a flurry of downsizing announcements that came especially from federal government agencies. As in every other major market, Class A spaces were most in demand, due to the flight-to-quality trend.

READ ALSO: East Coast Office Sector Trends: AREP Executives Weigh In

In one of the year’s largest deals, The Department of Justice signed a 331,000-square-foot lease at the Judiciary Center at 555 Fourth St. NW. However, the transaction marked a footprint reduction for DOJ, which will relocate from 477,473 square feet at 450 Fifth St. NW in early 2025.

In line with the downsizing trend, The Securities and Exchange Commission decided not to renew its 201,998-square-foot lease at Station Place III into 2024, while waiting for the completion of a 1.2 million-square-foot headquarters in NoMa.

Tysons Park Place II. Image courtesy of CommercialEdge

The U.S. Patent and Trademark Office will also reduce its Alexandria, Va., footprint from 2.4 million to 1.6 million square feet come August 2024, while The Bureau of Labor Statistics will reportedly relocate from its 500,000-square-foot DC headquarters at 2 Massachusetts Ave. NE to 300,000 square feet in Suitland.

But, while some companies relocate and downsize, other are staying put and adding to their totals. Hilton extended its 200,000-square-foot headquarters lease at Tysons Park Place II, a 320,000-square-foot office tower in McLean, Va., for another 15 years. The firm plans to add 350 new jobs at this location over the next five years.

Coworking decline in Q4

As an important subsector of the metro’s office market, coworking performed well throughout most of 2022. However, its activity started to decline in the fourth quarter, in conjunction with some 406,000 square feet of space being vacated by a few industry mainstays.

At the end of 2022, Washington, D.C., had roughly 3.1 million square feet of shared office space, representing 1.5 percent of its total rentable inventory. The metro lagged all other important gateway markets such as Miami (3.3 percent of rentable office space), Manhattan (2.7 percent) and Los Angeles (2.3 percent), but also Chicago (2 percent) and Boston (1.8 percent).

With an inventory of nearly 879,000 square feet, WeWork remains the largest coworking operator in the nation’s capital, even after downsizing its District footprint of late. Regus follows, with nearly 675,000 square feet of shared office space, while Industrious ranks third, with approximately 564,000 square feet.

In July, Industrious announced plans to open a new 41,245-square-foot coworking and flex office location in Washington, D.C. The company leased space at Illume, a luxury residential community owned by Oxford Property Group and J.P. Morgan Global Alternatives and developed by Greystar.

Lower PSF sale prices YoY

More than 16.6 million square feet traded across the metro in 2022 for a combined $4.13 billion; in the previous year, the transaction volume had reached 15.8 million square feet, while sales totaled $4.05 billion.

601 Massachusetts Ave., NW. Image courtesy of CommercialEdge

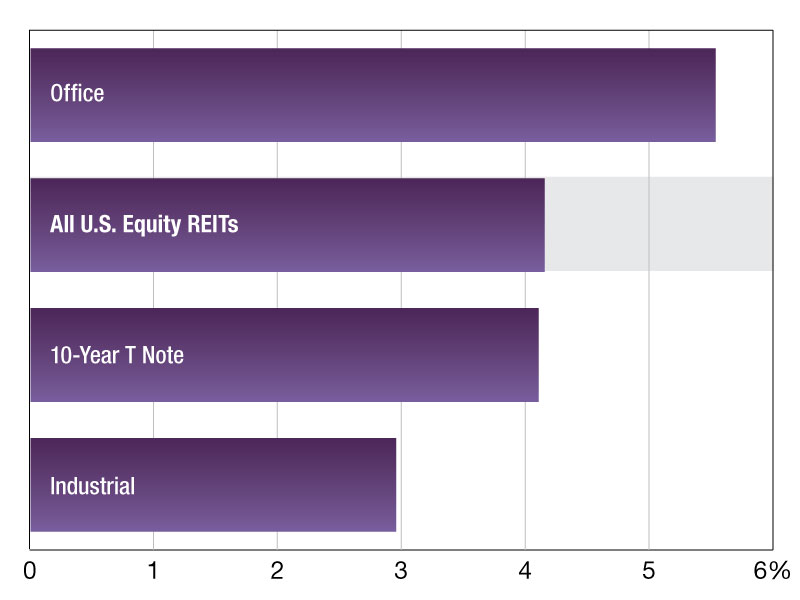

The median sale price per square foot of 2022 was $262.3, above the national average of $251.4 but down 10 percent year-over-year. The highest per-square-foot rate was registered in the year’s first quarter at $361.2, while the fourth quarter witnessed the lowest value, $150.8.

In Washington, D.C.’s largest deal of 2022, Boston Properties sold the 480,000-square-foot office building at 601 Massachusetts Ave. NW for $531 million. Tokyo-based Mori Trust acquired the Class A asset.

In another notable transaction, Nuveen Real Estate paid $375.4 million for the 520,180-square-foot Patrick Henry Building in the central business district of Washington, D.C. Tishman Speyer sold the 1973-built office mid-rise at 601 D St. NW in March.

One month later, Post Brothers purchased Universal North and South, a pair of Washington, D.C., office buildings for $228 million from JBG SMITH. Arranged by Newmark, the 659,459-square-foot acquisition marked the buyer’s entrance into the metro.

You must be logged in to post a comment.