Cap Rates

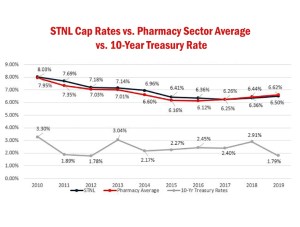

Single-Tenant Net Lease Cap Rates

Solid performance from Walgreens and similar retailers has caused the average pharmacy cap rate to diverge from the STNL average.

Single-Tenant Net Lease Cap Rates Creep Downward

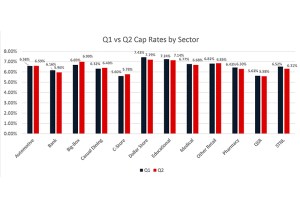

The dollar store sector posted the most significant change, with average cap rates falling from 7.43 percent to 7.19 percent, according to Calkain Research.

2018 Net Lease Office Sales Volume and Cap Rates

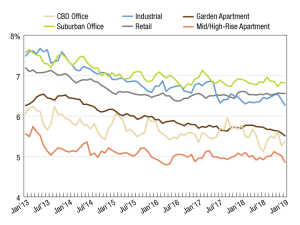

Average cap rates continued to fall, ending the quarter at 6.5 percent—a 4 basis-point drop from mid-year, and 9 basis points down from this time last year.

2019 Cap Rates

National property performance based on properties and portfolio sales of $2.5 million and greater across the multifamily, office, retail and industrial sectors, updated quarterly.

2018 Net Lease Industrial Sales Volume & Cap Rates

After bottoming out at 6.1 percent at mid-year, rates have seen noticeable increases during the last two quarters, ending the year at 6.32 percent.

2018 Net Lease Retail Sales Volume & Cap Rates

Single-tenant retail sales volume versus average cap rates, updated quarterly.

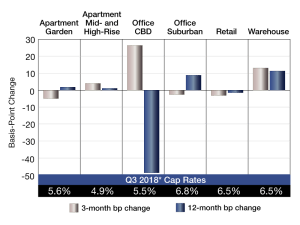

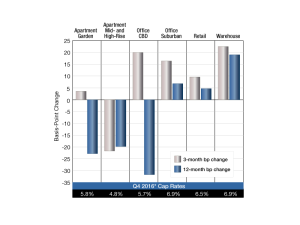

2018 Cap Rates

National cap rate performance comparing a three-month and 12-month basis-point change across all property sectors, updated quarterly.

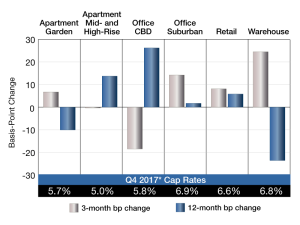

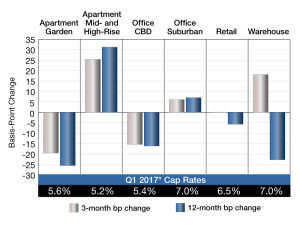

2017 Cap Rates

National cap rate performance comparing a three-month and 12-month basis-point change across all property sectors, updated quarterly.

- « Previous

- 1

- 2

- 3

- 4

- Next »