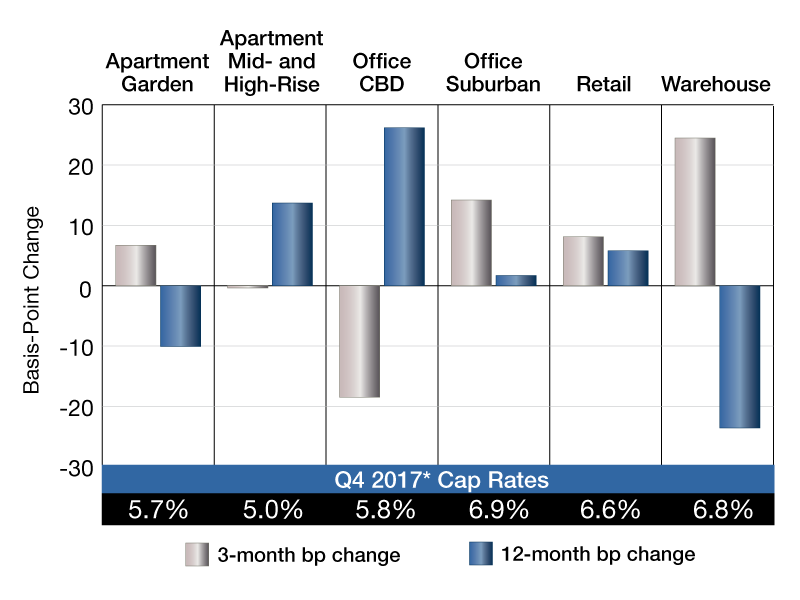

2017 Cap Rates

National cap rate performance comparing a three-month and 12-month basis-point change across all property sectors, updated quarterly.

Based on properties and portfolios of $2.5 million and greater

Cap rates for the fourth quarter of 2017 were between 5.7 and 6.9 percent, with Suburban Office and Warehouse recording the highest rates. Mid- and High-rise apartments traded at the lowest cap rates (5.0 percent), followed by Garden apartments at 5.7 percent. CBD office cap rates decreased 18.5 basis points in the fourth quarter of the year, while Mid- and High-rise apartments decreased slightly by 0.4 basis points. Year-over-year, CBD office assets commanded the highest growth for commercial properties (26.2 basis points), while the most significant drop was posted by Warehouse facilities (23.6 basis points decline). The most substantial drop in residential properties year-over-year was 10.1 basis points for Garden apartments, while Mid- and High-rise apartment cap rates gained 13.7 basis points.

—Posted on Mar. 20, 2018

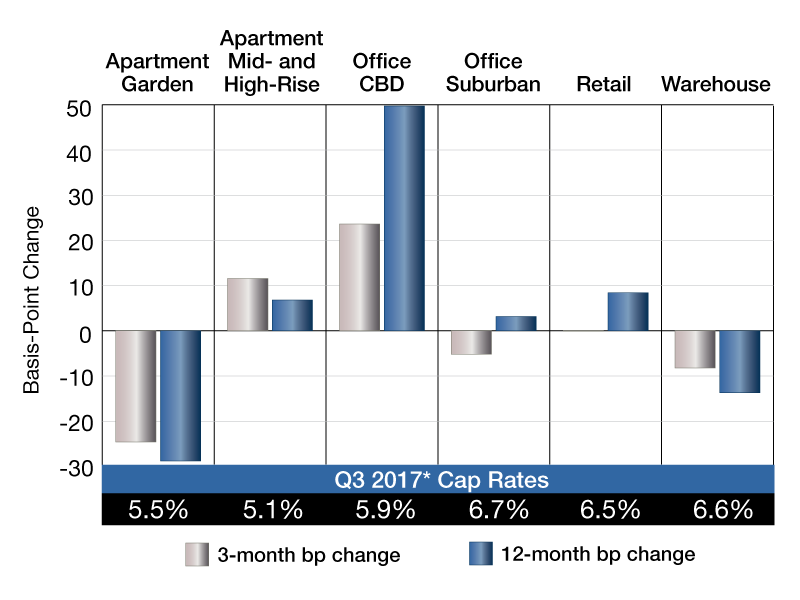

Based on properties and portfolios of $2.5 million and greater

Cap rates for the third quarter of 2017 were between 5.1 and 6.7 percent, with Suburban Office and Warehouse posting the highest rates. Mid- and High-rise apartments traded at the lowest cap rates at 5.1 percent, followed by Garden apartments at 5.5 percent. CBD office cap rates increased by more than 23 basis points in the third quarter of the year, while Garden apartments dropped by almost 25 basis points and Warehouse decreased by 8.2. Year-over-year, CBD office assets commanded the highest growth for commercial properties (49.7 basis points) and the most significant decrease was for Warehouse facilities (-13.7 basis points). The most substantial drop in residential properties on a year-over-year basis was 28.8 basis points for Garden apartments, while Mid- and High-rise apartment cap rates increased by 6.8 basis points.

—Posted on Dec. 30, 2017

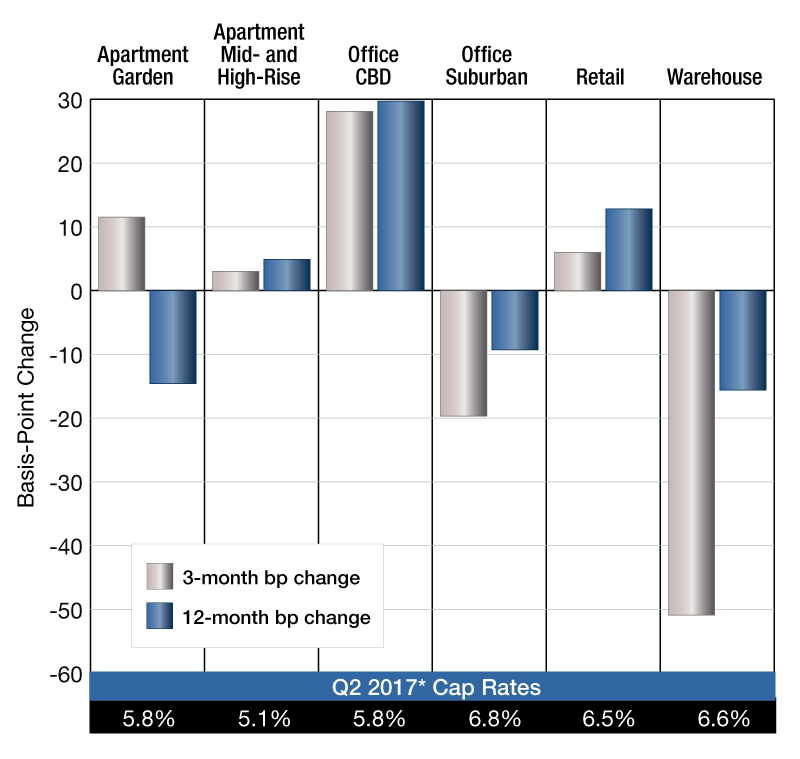

Based on properties and portfolios of $2.5 million and greater

Cap Rates for the second quarter of 2017 were between 5.1 and 6.8 percent, with Suburban Office and Warehouse commanding the highest rates. Mid- and High-rise Apartment properties traded at the lowest cap rates: 5.1 percent. CBD office cap rates have increased by more than 28 basis points in the past three months, while Warehouse cap rates decreased by 50.9 basis points. Year-over-year, the biggest cap-rate growth for commercial properties was 29.7 for CBD Office, and the most significant decrease was in Warehouse properties (-15.6 basis points).

You must be logged in to post a comment.