Single-Tenant Net Lease Cap Rates

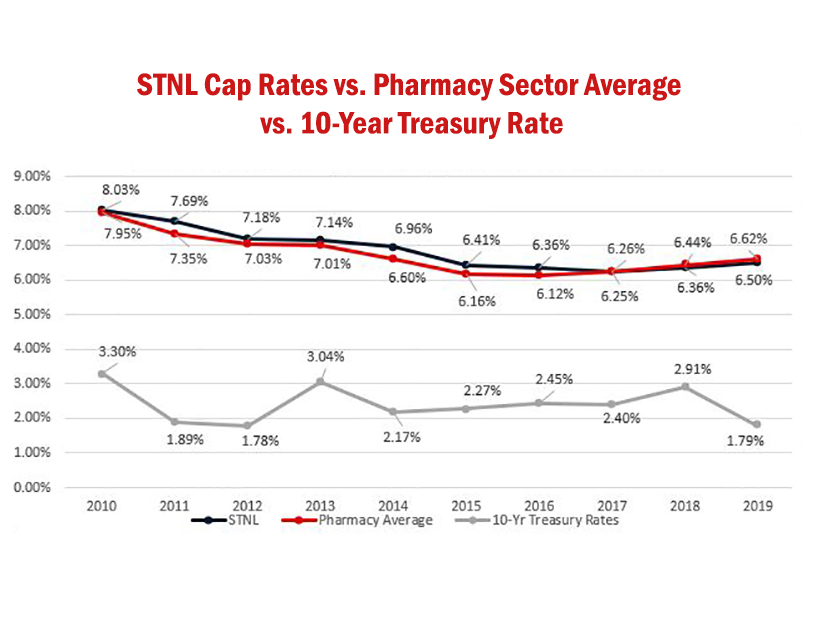

Solid performance from Walgreens and similar retailers has caused the average pharmacy cap rate to diverge from the STNL average.

Pharmacy and single-tenant net lease average cap rates have remained close in value throughout the years. In 2017, pharmacy value passed STNL average for the first time. The gap between the pharmacy cap rate average and STNL has been increasing, likely due to Walgreens average pulling it up. In 2019, we experienced the lowest 10-Year Treasury Rates since 2012.

Pharmacy and single-tenant net lease average cap rates have remained close in value throughout the years. In 2017, pharmacy value passed STNL average for the first time. The gap between the pharmacy cap rate average and STNL has been increasing, likely due to Walgreens average pulling it up. In 2019, we experienced the lowest 10-Year Treasury Rates since 2012.

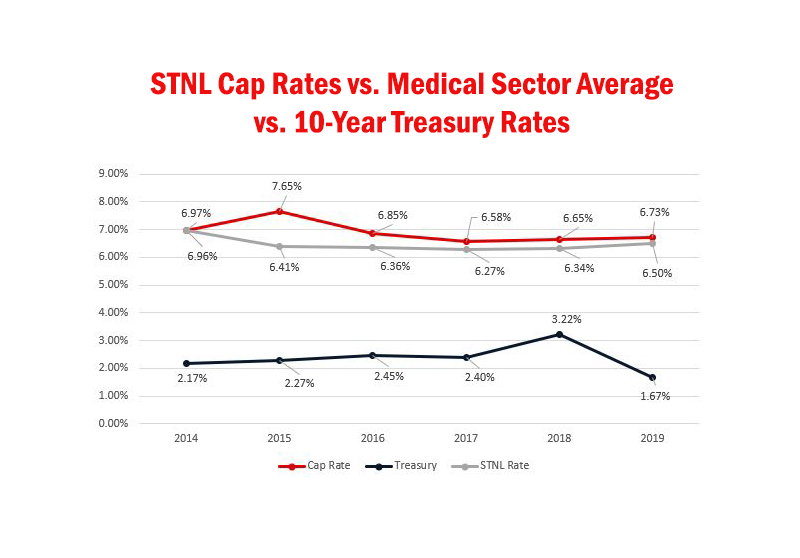

Over the past couple of years, the medical sector has begun trending closer to the Single Tenant Net Lease average. This stems from the concentration of highly rated tenants within the sector and number of overall properties being sold. While Fresenius and DaVita make up the majority of sales pertaining to dialysis clinics, there is a more diverse landscape for urgent cares, allowing competition within the market. With interest rates having been lowered again a few months ago, we should keep an eye on this sector and how the rates react. See more in Calkain’s latest Medical Sector Report.

Over the past couple of years, the medical sector has begun trending closer to the Single Tenant Net Lease average. This stems from the concentration of highly rated tenants within the sector and number of overall properties being sold. While Fresenius and DaVita make up the majority of sales pertaining to dialysis clinics, there is a more diverse landscape for urgent cares, allowing competition within the market. With interest rates having been lowered again a few months ago, we should keep an eye on this sector and how the rates react. See more in Calkain’s latest Medical Sector Report.

Posted on Nov. 20, 2019

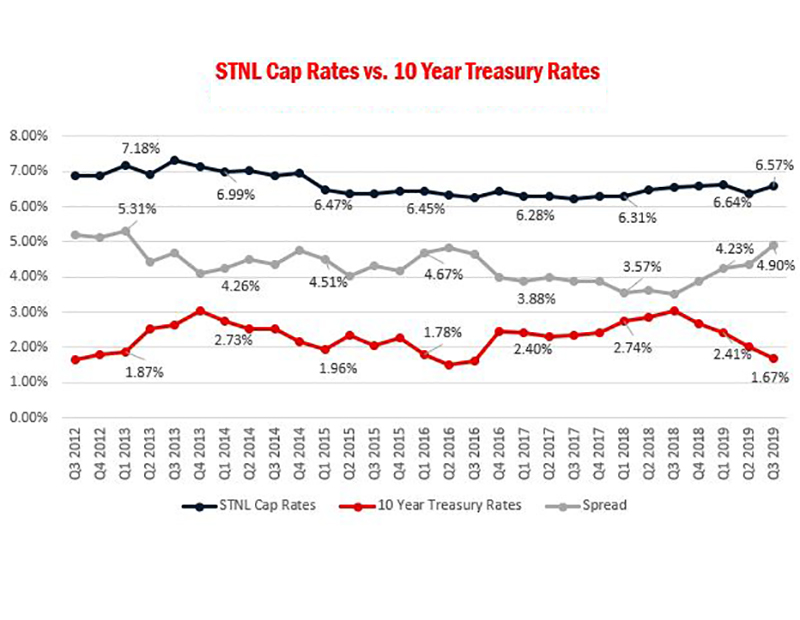

Third quarter 2019 was the fourth quarter in a row where we have seen the 10-Year Treasury rate decrease and the spread between single-tenant net lease cap rates and the 10-year Treasury is the highest it has been since Q2 2016 (4.83 percent vs. 4.90 percent). The average cap rate has increased since going down in Q2. The total number of sales has risen, showing consumer confidence in the market.

Posted on Oct. 16, 2019

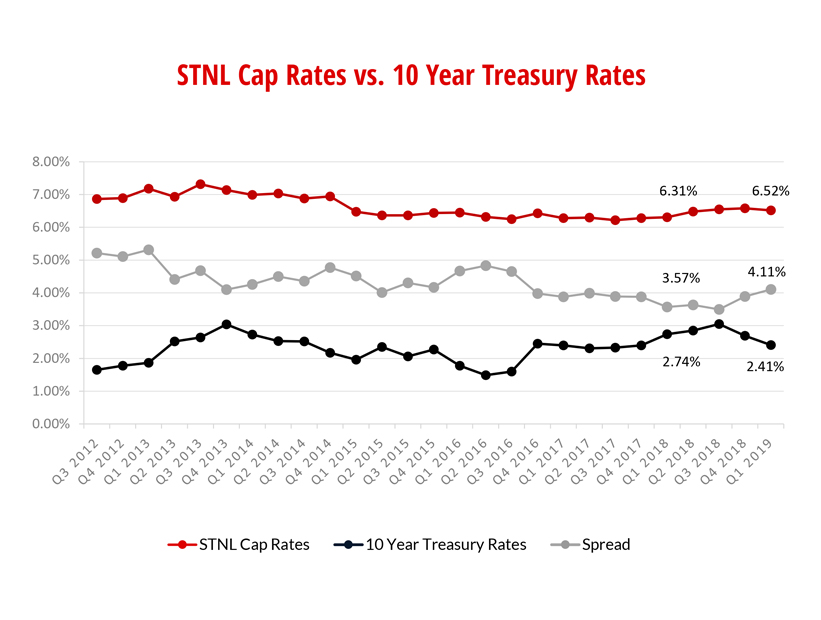

Source: Source: Calkain Cos. Q1 Cap Rate Report

Source: Calkain Cos. Q1 Cap Rate ReportThis is the third straight quarter in which we have seen the 10-Year Treasury rate decrease with the spread increasing to over 4 percent for the first time since Q2 2016. The STNL cap rate decreased across two quarters for the first time since Q2 to Q3 2017. The Fed has backed off of toying with interest rates (which now approach 2016 levels) and transactions are ticking up. The ongoing nature of the robust economy promises a continued long run, but recession or not, many investors are taking flight to quality and the sure, long-term returns of net lease.

You must be logged in to post a comment.