Jamie Woodwell

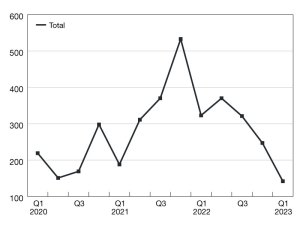

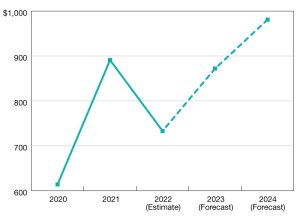

Commercial/Multifamily Borrowing Declines 56 Percent in First-Quarter 2023

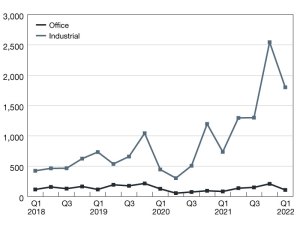

Commercial and multifamily mortgage loan originations were 56 percent lower in the first quarter of 2023 compared to a year ago.

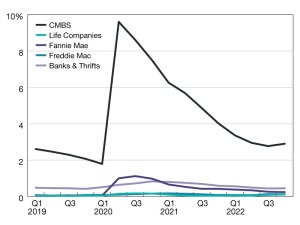

Commercial and Multifamily Mortgage Delinquency Rates Remain Low in Fourth Quarter 2022

Commercial and multifamily mortgage delinquencies remained low in the fourth quarter of 2022, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Delinquency Report, released earlier this month.

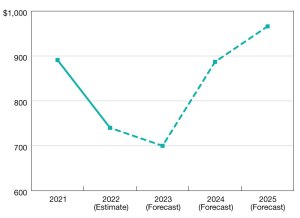

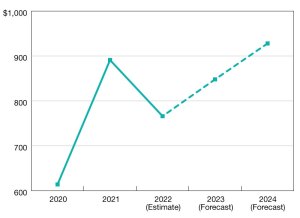

CRE Lending to Slip in 2023, MBA Predicts

After a 5 percent decline, volume is expected to bounce back next year.

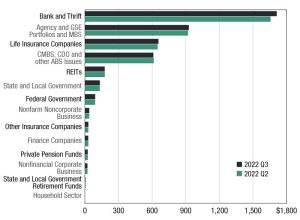

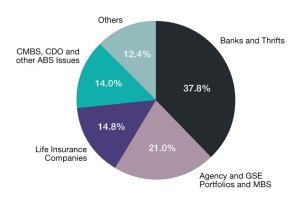

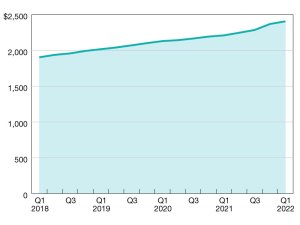

Commercial and Multifamily Mortgage Debt Outstanding Increased by $70 Billion in Third-Quarter 2022

Total commercial/multifamily mortgage debt outstanding rose to $4.45 trillion at the end of the third quarter.

Commercial/Multifamily Lending Expected to Fall in 2022 Due to Ongoing Economic Uncertainty

Commercial/Multifamily borrowing and lending started the year on strong footing, but higher rates and economic uncertainty have impacted demand and activity during the second half of the year.

Commercial Mortgage Debt Outstanding Rises to New Record in Q1 2022

Total mortgage debt outstanding rose to $4.25 trillion, according to MBA’s latest report.

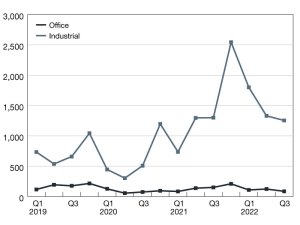

Commercial Originations Jumped 72% in Q1 2022

Those during the first three months of the year were 39 percent lower than the previous fourth quarter, according to MBA.