Commercial and Multifamily Mortgage Delinquency Rates Remain Low in Fourth Quarter 2022

Commercial and multifamily mortgage delinquencies remained low in the fourth quarter of 2022, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Delinquency Report, released earlier this month.

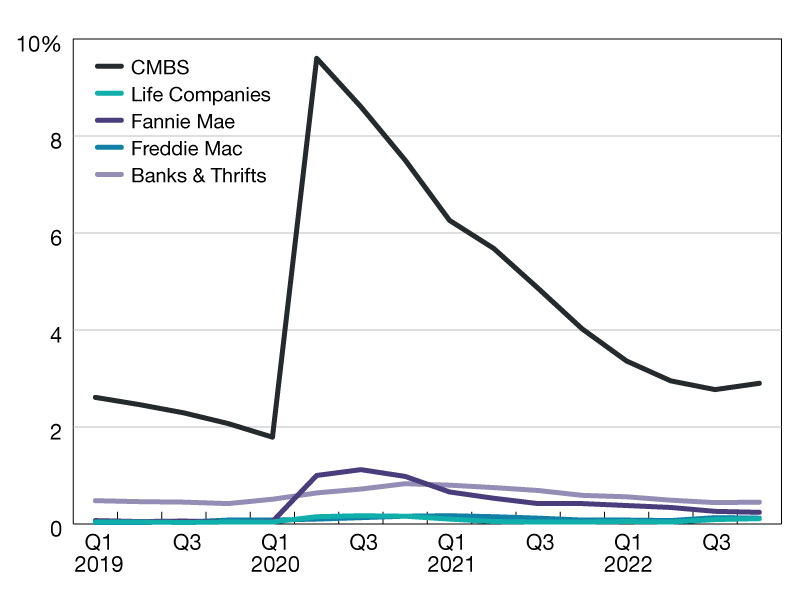

Commercial and multifamily mortgage delinquency rates remained low at the end of 2022. There were slight upticks among loans in CMBS, life companies, and banks and decreases for Fannie Mae and Freddie Mac but the overall performance remained positive. It is likely that as higher interest rates and softer property values work through the system this year – prompted by maturing and adjustable-rate loans – loan performance will adjust.

Based on the unpaid principal balance (UPB) of loans, delinquency rates for each group at the end of the fourth quarter of 2022 were as follows:

- Banks and thrifts (90 or more days delinquent or in non-accrual): 0.45 percent, an increase of 0.01 percentage points from the third quarter of 2022;

- Life company portfolios (60 or more days delinquent): 0.11 percent, an increase of 0.02 percentage points from the third quarter of 2022;

- Fannie Mae (60 or more days delinquent): 0.24 percent, a decrease of 0.02 percentage points from the third quarter of 2022;

- Freddie Mac (60 or more days delinquent): 0.12 percent, a decrease of 0.01 percentage points from the third quarter of 2022; and

- CMBS (30 or more days delinquent or in REO): 2.90 percent, an increase of 0.13 percentage points from the third quarter of 2022.

MBA’s quarterly analysis looks at commercial/multifamily delinquency rates for five of the largest investor-groups: commercial banks and thrifts, commercial mortgage-backed securities (CMBS), life insurance companies, Fannie Mae and Freddie Mac. Together, these groups hold more than 80 percent of commercial/multifamily mortgage debt outstanding. MBA’s analysis incorporates the measures used by each individual investor group to track the performance of their loans. Because each investor group tracks delinquencies in its own way, delinquency rates are not comparable from one group to another.

For more information, click here.

You must be logged in to post a comment.